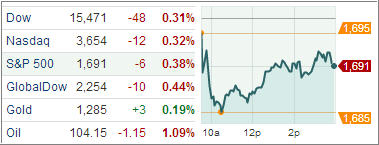

U.S. equities continued their red figures for a third consecutive session on Wednesday amid a mixed bag on the earnings front, while a sedentary economic calendar offered little help. Mortgage applications snapped a seven-week losing streak, while consumer credit expanded.

Growing uncertainty over when the Federal Reserve may start to wind down its stimulus played a part over last few trading sessions. Stocks sold off at the open after Asian indices endured a downbeat session with Japan’s Nikkei falling 4.0% as dollar/yen continued its recent weakness.

In earnings news, Dow member Walt Disney bested analysts’ expectations, but its studio entertainment unit underperformed. Moreover, Time Warner topped expectations and boosted its business outlook, and AOL beat estimates, while announcing an agreement to acquire Adap.tv and an increase to its share repurchase program.

Although the S&P was able to trim its losses, the index could not regain its flat line as the underperformance of influential cyclical sectors weighed. Financials and discretionary shares both lost near 0.8%. In addition, the industrial sector outperformed with a loss of 0.2%. The discretionary sector displayed broad weakness with notable losses among home builders and retailers.

Moreover, most major bank shares registered losses and Bank of America slid 0.8% after the Department of Justice filed a pair of lawsuits alleging the bank has engaged in investor fraud when selling $850 million in residential mortgage-backed securities.

The relative strength of most countercyclical sectors helped the S&P benchmark index erase about half of its losses during the afternoon. Health care and telecom services ended little changed while utilities registered a modest gain of 0.5%. For its part, the consumer staples sector (-0.5%) lagged.

Our Trend Tracking Indexes (TTIs) pulled back as well with the Domestic TTI ending at +3.35% while the Domestic TTI closed at +6.79%.

Contact Ulli