U.S. equity indexes ended this volatile session on a mixed note, after the release of the minutes from the Federal Reserve’s June policy meeting created uncertainty over when and if the central bank will start to trim the stimulus.

Attention shifted to focus on the speech by Chairman Ben Bernanke to begin after the closing bell. The Chairman says the U.S. economy still needs help from the Fed’ low interest rate policies, and because unemployment remains high and inflation is below the Fed’s target, the policies are still necessary. However, just like the Fed’s minutes, Bernanke failed to signal any changes in the bond-buying program during his remarks.

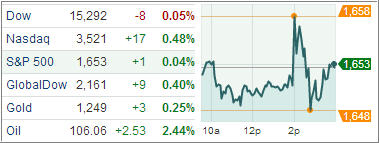

On the markets, energy and financials displayed weakness throughout the day before settling near their lows. The energy sector shed 0.6% despite the continued rise in crude oil, which added 2.4% to $106.04 per barrel. The energy component has rallied steadily since late June, and reports of a well leak off the coast of Louisiana contributed to today’s strength.

Elsewhere, major banks registered losses across the board as the financial sector settled lower by 0.6%. Also of note, the Dow Jones Transportation Average fell 1.0% after jumping 2.3% yesterday. While most cyclical groups finished in the red, technology advanced 0.5% as most of its top components registered gains. Countercyclical consumer staples, health care, and utilities added between 0.1% and 0.7% while the telecom services sector shed 0.4%.

Economic news was mainly focused on the Minutes from the central bank’s June 18-19 meeting, released today in Washington. It showed that several members judged that a reduction in asset purchases “would likely soon be warranted.” However, the Fed will continue to look for more evidence suggesting projected acceleration of growth remains on track such as more signs of employment to pick up before they’ll begin slowing the pace of $85 billion in monthly bond purchases. That was not the only reason to today’s volatile session.

Wholesale inventories fell 0.5% in May, the biggest drop since September 2011, and contrary to expectations for a 0.3% gain.

Meanwhile, the recent advance of mortgage rates continued to weigh on mortgage applications volume. The MBA Refinance Index fell 4.4% last week, its eighth decline in the past nine weeks, reaching its lowest level since July 2011. Refinances continue to trend lower, down 41.3% on a y/y smoothed basis, the most since May 2010. The end of the refinance boom could weigh somewhat on consumer spending in the second half of 2013.

Due to the primarily sideways action of the major indexes, our Trend Tracking Indexes (TTIs) moved only slightly with the Domestic TTI ending at +2.05% while the International TTI closed at +4.95%.

Contact Ulli