Despite an early rally following upbeat European economic data, the major averages were unable to hold their flat lines past the opening 90 minutes, reversed course to close lower for a third-straight trading day.

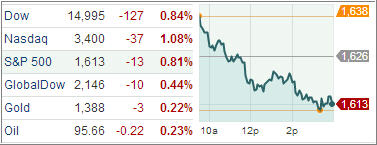

The Standard & Poor’s 500 Index spent the entire day in a steady decline as minor bounces were met with aggressive selling. The Index lost 13 points (0.8%) to 1,613; while the Dow Jones Industrial Average declined 127 points (0.8%) to 14,995, and the Nasdaq Composite tumbled 37 points (1.1%) to 3,400.

Volatility spiked by exacerbated skepticism of the continuity of global central bank stimulus efforts. All 10 main industries in the S&P 500 retreated. Utility stocks fell 1.1 percent, extending a six-week decline to 11 percent. Cyclical sectors led to the downside as financials and discretionary shares ended with losses near 1.0%. Meanwhile, the defensive cousin of the discretionary space, consumer staples (XLP), outperformed the broader market with a loss of only 0.6%.

Also of note, the utilities sector slid 1.1% to widen its quarter-to-date loss to 5.4%. This marks a sharp turn for the sector which was among the first-quarter leaders. However, the recent rise in interest rates has contributed to the softness of the high-yielding sector.

Traders have kept their focus on the possibility that the Federal Reserve will reduce its monthly bond purchases in coming months, removing one of the pillars of the U.S. stock market’s rally this year. These worries have sparked volatility and triggered a pullback in U.S. stock indexes from historic highs.

The Dow on Wednesday swung more than 200 points for the seventh time in the past 15 trading days, going back to Fed Chairman Bernanke’s latest congressional testimony on May 22. Today’s selloff pushed the CBOE Volatility Index to its second-highest level of the year as investors adjusted their near-term volatility expectations.

Economic news included the weekly MBA Mortgage Applications Index which rose 5.0% to follow the prior week’s decline of 11.5%. The May Treasury Budget showed a deficit of $138.7 billion, which was slightly ahead of the deficit of $139.0 billion expected by the consensus.

Overseas, Eurozone industrial production rose 0.4% month-over-month in April, versus the flat pace of growth that economists had expected. Elsewhere, according to CNBC, the German government is encouraging the court to throw out the legal challenge of the European Central Bank’s bond-buying program.

Investors get their next look at the health of the U.S. economy tomorrow, when weekly initial claims, May retail sales, export and import prices all will be released before the opening bell.

Will the volatility continue?

The answer is very likely “yes,” if the the Fed leaves the markets in the dark about its potential tapering of the bond buying program. From a technical point, it will be important that the S&P 500 does not break below its 50-day moving average, which is a widely followed indicator. As of today, SPX remains 0.35% above it.

It’s no surprise that our Trend Tracking Indexes (TTIs) weakened with the overall market. The Domestic TTI dropped to +2.08% while the International TTI ended the day at +4.71%.

Our low volatility positions have come off their highs; all sell stop points have been identified and will be executed once the market gives the signal.

Contact Ulli

Comments 1

RT @TheETFBully: Pull-Back Is Gaining Momentum http://t.co/d1RlEU8uBV