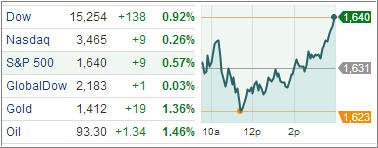

Stocks opened a new trading week with gains Monday in a choppy session, despite dismal data which supported views the Federal Reserve will keep economic stimulus in place. The Dow Jones Industrial Average rose 138 points (0.9%) to 15,254, the S&P 500 Index moved 10 points (0.6%) higher to 1,640, and the Nasdaq Composite appreciated by 9 points (0.3%) to 3,465.

Trading was volatile on higher-than-average volume with 879 million shares were traded on the NYSE, and 2.0 billion shares changed hands on the Nasdaq. All three indexes gained at the open, but the S&P 500 and Nasdaq turned negative in late morning before reversing course again to finish higher.

The tech sector registered a slim gain while biotechnology put on pressure throughout the day. The iShares Nasdaq Biotechnology ETF (IBB) fell 1.2%. While the afternoon rally enabled most sectors to erase their early losses, financials, homebuilders, and transportation-related stocks watched from the sidelines.

Major financials displayed mixed performance, the sector ended little changed. Elsewhere, the weakness in homebuilders sent the SPDR S&P Homebuilders ETF (XHB) back to its early May levels as the ETF lost 0.9%. Softness among airlines and truckers pressured the Dow Jones Transportation Average as the bellwether complex ended flat.

Finally, consumer staples, which helped lead recent losses along with other sectors that included many stocks that pay high dividends rose 1.1 percent and was the day’s best-performing sector. U.S. bond prices were flat to higher. Speculation the Fed may reduce its monetary stimulus earlier than expected has pushed stocks down in recent sessions and lifted bond yields.

In economic news, the Institute for Supply Management Manufacturing Index unexpectedly dropped into contraction territory at the fastest pace since June 2009, falling to 49.0 in the month of May from 50.7 in April, compared to the rise to 51.0 forecasted by economists. A level of 50 is the demarcation point between expansion and contraction.

The weaker-than-forecasted report came as factory activity has waned as across-the-board federal budget cuts took hold and overseas markets struggled to improve. Elsewhere, construction spending came in below expectations, rising 0.4% month-to-month in April, versus the projection of economists calling for a 0.9% increase. Residential spending fell 0.1%, while non-residential spending rose 2.2%.

Japan equities experienced a new six-week low in the Nikkei 225 Index, following weaker-than-expected diverging manufacturing data out of China and a 4% drop in Japanese corporate capital spending in the first quarter.

Stocks in Europe also finished lower as disappointing manufacturing reports from the US and China overshadowed positive manufacturing data throughout the region. The economic picture remains relatively supportive of continued gains in equities, staying in that kind of sluggish growth spot that allows the fed to stay ultra-accommodative while not nearing contraction territory.

Our Trend Tracking Indexes (TTIs) showed some improvement from last Friday’s drubbing and ended the day higher with the Domestic TTI closing at +3.35% while the International TTI inched to +6.76%.

Contact Ulli