Despite a strong spate of earnings and merger news, U.S. equities gave back a large portion of yesterday’s gains. Stocks backed off today as high-yielding dividend stocks lost some of their luster after recent increases in U.S. Treasury bond yields.

Equities slipped out of the gate as sellers drove the major averages to their lows 90 minutes into the session. This marked the return of bargain hunters, who helped the Standard & Poor’s 500 Index return to its opening levels.

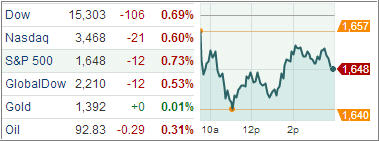

However, the relative weakness of several influential groups kept the benchmark average from regaining its flat line. The Dow Jones Industrial Average lost 107 points (0.7%) to 15,303, the S&P 500 Index declined 12 points (0.7%) to 1,648, and the Nasdaq Composite descended 21 points (0.6%) to 3,467.

Indexes made up of consumer staples, health care, telecommunications and utilities shares all ended with losses larger than 1.5%. The defensive sectors have led the gains in this year’s market rally as investors favored high-dividend stocks over fixed-income securities in a low interest-rate environment.

Benchmark Treasury yields overnight hit 2.235 percent – the highest in more than a year – and have risen since last week when Federal Reserve Chairman Ben Bernanke raised fears that the Fed would curb its bond-buying program sooner than expected. The spread between the S&P 500 dividend yield and the 10-year U.S. Treasury note’s yield is at its narrowest in about a year. The S&P 500 dividend yield was about 2.39 percent near Wednesday’s close.

Economic news of the day was limited to the weekly MBA Mortgage Index, which fell 12.3% last week, its third straight decline, as mortgage rates headed up. A lowered global economic growth outlook from the OECD also helped to fuel selling pressure. The Organization for Economic Cooperation and Development (OECD) issued its semiannual economic outlook.

While it noted that the U.S. was seen as driving global growth and Japan’s economy is expected to rebound, it cut its global growth outlook slightly, as the Eurozone was expected to remain in a recession and its Chinese output forecast was lowered. Moreover, the OECD mentioned that monetary policy in the U.S. needs to remain extraordinarily easy, but the pace of further easing through additional asset purchases may need to be gradually reduced.

Is “easy come, easy go” the new theme of the market? Who knows, but uncertainty is definitely increasing as the questions remains whether this is just a temporary pullback or the beginning of the end of this aging bull cycle.

Fortunately, we don’t have to guess or dig for an answer; we will simply follow our sell stop rules and exit our positions once the stops have been triggered.

Today’s weakness showed up in our Trend Tracking Indexes (TTIs) as well, as the Domestic TTI retreated to +3.74% while the International TTI pulled back to +8.12%.

Contact Ulli