Stocks were off to the races Wednesday, as the S&P 500 marched to its highest level ever. Markets climbed 1 percent on Wednesday, with both the Dow and S&P 500 ending at historic highs as cyclical shares led the way higher for a second straight day.

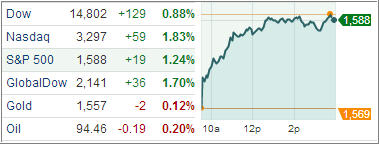

The S&P 500 finally surged past the record set in Oct 2007, joining the new all-time intraday high club. The index has struggled to breach the level of 1,576.09 for the past several weeks, but surpassed above it on Wednesday to rally as high as 1,589.07. The Dow also hit another intraday milestone, rising as high as 14,826.66.

All 10 industries in the S&P 500 advanced. Buying was focused in the tech and health-care sectors as they surged 1.8 percent. The S&P 500 and Dow rose 1.2 percent and 0.9 percent, respectively. In another encouraging sign, data showed NYSE and Nasdaq volume in the stock market today was higher than Tuesday’s levels. However, it remained below the daily average so far this year of about 6.36 billion shares.

The big story of the day was that President Barack Obama sent a $3.8 trillion budget to Congress calling for more tax revenue and slower growth for Social Security benefits. This is a political gamble intended to revive deficit-reduction talks.

More than two months after the Feb. 4 deadline, after Congress’s parties deadlocked over taxes and spending, President Obama wants to again rely on wealthy U.S. households for most of the tax increases he’s proposing. The administration forecasts that the federal budget deficit for the fiscal year that begins Oct. 1 will be $744 billion, or 4.4 percent of the economy.

In other news, small businesses, which employ the bulk of American workers, don’t plan to hire additional staff, new data showed Tuesday, in another sign the job market is deteriorating again.

According to the National Federation of Independent Business, confidence among small firms dropped from 90.8 in February to 89.5 in March. Imports to China rose 14.1 percent in March from the year earlier, leaving the nation with an unexpected trade deficit.

In Japan, Prime Minister Shinzo Abe said “bold monetary easing” will reverse persistent deflation in his nation. The central bank will take all steps necessary to meet a 2 percent inflation target. The European Central Bank will keep rates low and continue injecting liquidity into the banking system.

With this much upward momentum, it was no surprise to see our Trend Tracking Indexes (TTIs) march north again as well. The Domstic TTI ended the day at +3.96% while the International TTI closed at +8.21%.

While this rally is in no way connected to economic fundamentals, which have not been improving, we will enjoy the ride for as long as it lasts until that moment when our trailing sell stops give us the sign to exit. Not having any kind of exit strategy is simply unwise, to say it politely, as reality is bound to knock the indexes off these lofty levels at some point.

Contact Ulli