While the S&P 500 only gained 0.38% since last week’s ETF Model Portfolio report, it was a gain nonetheless. With metals tanking and bond prices sinking, it has become clear that the Fed’s primary goal is to continue to lift the equity indexes so that we all can feel the wealth effect and consequently engage in rampant spending to prop up the ailing economy—or so the theory goes.

As I posted before, bond ETFs have gone nowhere this year, which is why we have eliminated most of them for our managed account clients. I have found that the most appropriate holdings in this environment are low volatility ETFs, many of which have outperformed the major indexes by a good margin YTD.

The low volatility part will help us to stay on board a while longer should the next correction turn out to be fairly shallow and followed by the dip-buying-crowd pushing the indexes back up to higher levels.

In the meantime, here is the latest update for our Model ETF Portfolios, which you can use based on your risk tolerance:

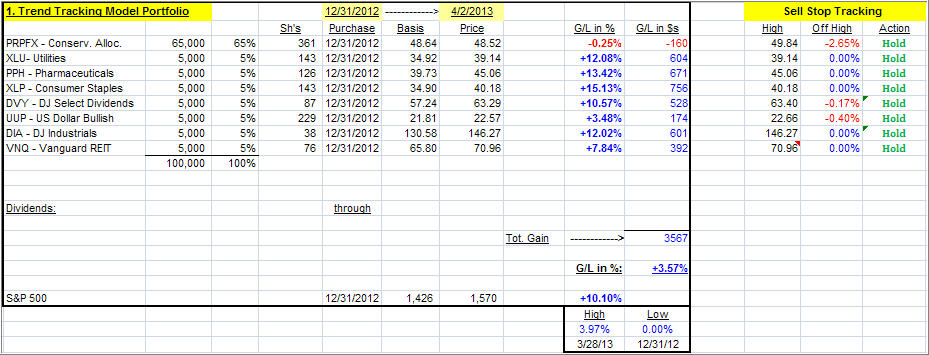

1. ETF Trend Tracking Model Portfolio

[Click on any table to enlarge]

[Click on any table to enlarge]

This is the portfolio allocation I have used predominantly in my advisor practice during the first half of 2011, although it lagged in 2012 and 2013 with PRPFX being the culprit due to the Fed’s relentless money pumping efforts that are having a more positive effect on equity and sector ETFs—that is until the bubble bursts.

Around the PRPFX fund, when in buy mode, I add what I call boost components consisting of ETFs that can produce higher returns than my core holding, at least during bullish periods. When a market pullback occurs, the core holding should add an element of stability.

Nevertheless, as you know from my writings, anything I invest in involves the use of trailing sell stops, which are shown and tracked on the upper right of the table.

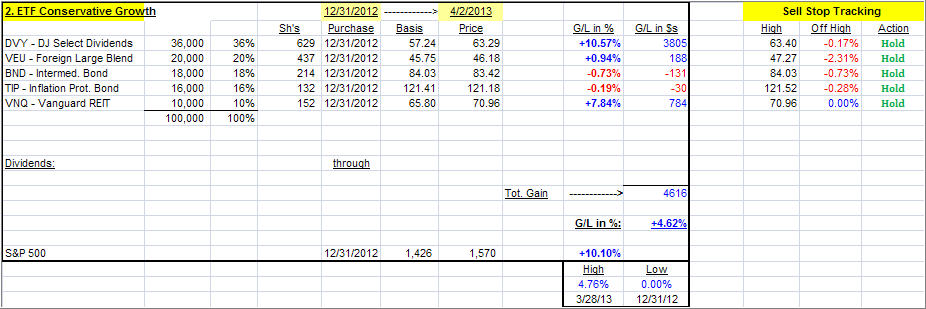

2. Conservative ETF Growth Portfolio

This portfolio, as are the following ones, would be typical of what is being used in the buy-and-hold community, as you can see by the 40% allocation to various bond ETFs. If you are conservative, this simple combination could work for you, but I still recommend the use of the trailing sell stops during these uncertain times.

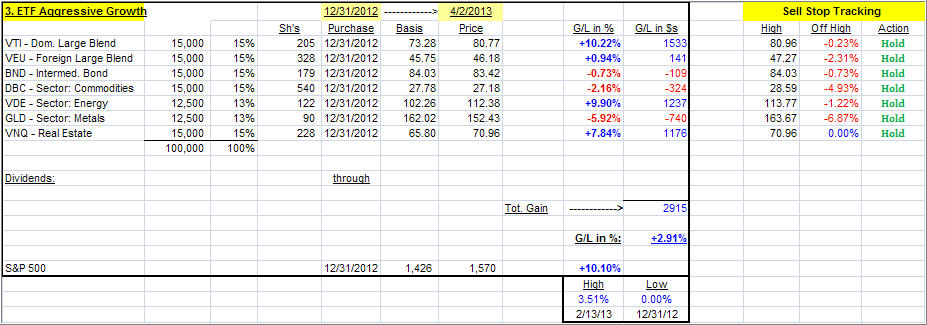

3. Aggressive ETF Growth Portfolio

What makes this one aggressive is the small 15% allocation to bonds. If you have an aggressive streak in your personality, you could consider this one. If you use my recommended sell stop discipline, you know exactly ahead of time what your downside risk will be.

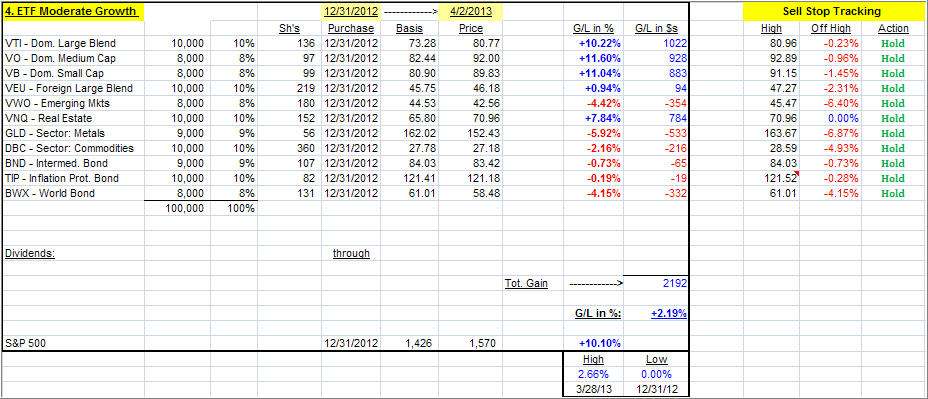

4. Moderate ETF Growth Portfolio

I call this one moderate growth, because of the higher allocation to various bond ETFs (27%) than in the aggressive set up above. It is also more diversified domestically.

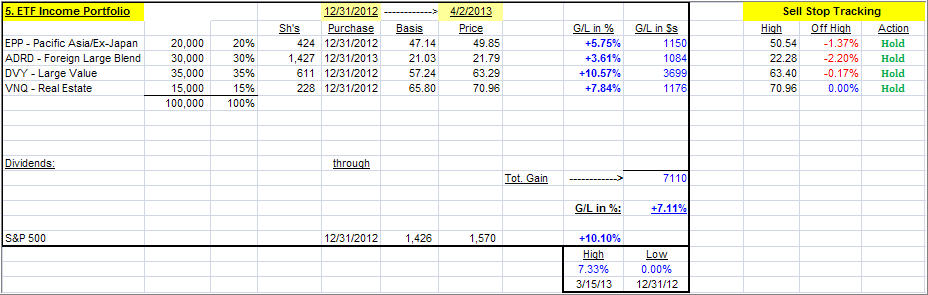

5. ETF Income Portfolio

This is as simple as it gets, but this model held up well in 2012 and turned out to be the top performer out of the seven I feature. Only two ETFs were stopped out during the past year, and the proceeds were subsequently re-invested as the upward trend emerged again.

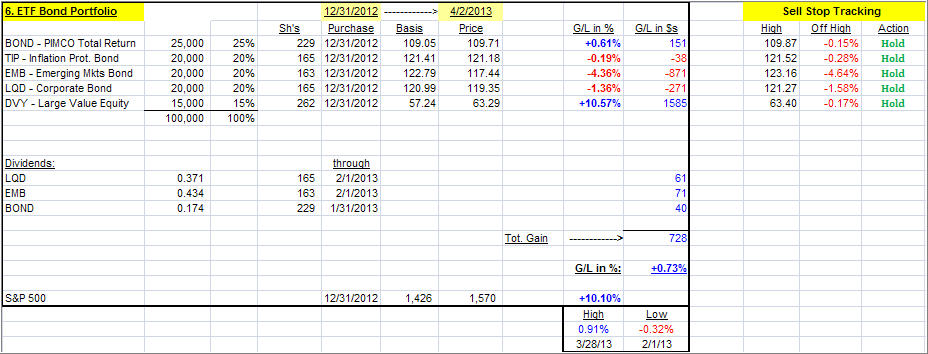

6. ETF Bond Portfolio

Many readers have asked for an ETF Bond portfolio, which I have set up in this section; it replaces the old Ivy Portfolio.

With the global slowdown underway, bonds continue to have upside potential until higher interest rates caused by inflationary tendencies will bring this rally to an end. Fed policy is promoting lower rates for another couple of years or so, but market pressures due to unintended consequences could bring this trend to a sudden end, which is why the use of my recommended sell stops is critical.

Even though this is a bond portfolio, I believe some small equity exposure (DVY) is vital should the relentless pumping of equities continue.

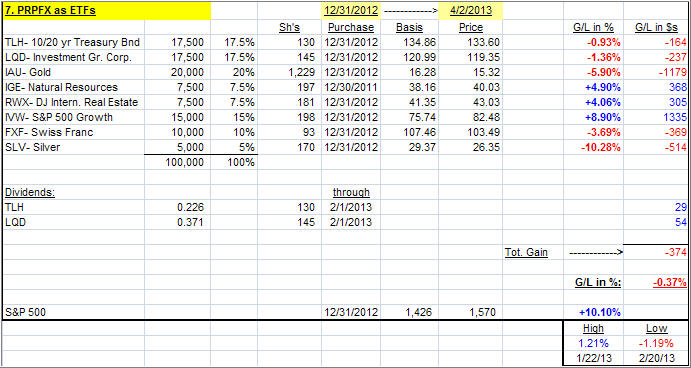

7. The ETF Equivalent of PRPFX

As posted recently, I have created and back tested the ETF equivalent of my favorite mutual fund, PRPFX, which is a core holding in my #1 Portfolio. If you missed it, you can read the announcement here.

Take a look at the combination of ETFs:

Since these 8 ETFs represent only one fund, namely PRPFX, we can apply a different exit strategy. For that purpose, I will not track the high points made for each ETF, as with the other 6 models, but measure my 7% drop from the high point this entire portfolio has made.

Alternatively, you can sell this entire portfolio once our domestic TTI has crossed into bear market territory or hold on to only those positions that are maintaining upward momentum. That solves the issue of “what to buy” if you had liquidated 100%.

(ETF trading costs are not included in these portfolios demonstrations. They are intended to show market effects on different scenarios only as an educational tool)

To repeat, the key to selecting a portfolio from the above list is not just performance. Personally, I’d rather lag a little on the upside but have some assurance that I will also lag when the downside comes into play.

I will update these portfolios every Wednesday.

Quick Reference:

Disclosure: I may have personal and/or client holdings in some of the funds/ETFs discussed above

Contact Ulli