US stocks advanced Tuesday, recouping more than half of Monday’s biggest decline in the benchmark indices since November as Bernanke defended the Fed’s policy amid solid housing and consumer confidence data. The jury is still out whether that was just a low volume dead cat bounce, or the beginning of something more.

Economic activity in the US has continued to expand at a moderate and uneven pace, Bernanke said in his testimony while defending the Fed’s unprecedented asset purchase program. There is little risk of inflation or asset-price bubbles, the central banker told lawmakers in the first-day of his semi-annual monetary policy report to Congress and cautioned automatic spending cuts, set to begin Friday, will impose a significant burden on economy if politicians are unable to reach a deal to avert the cuts.

In economic news, data released by the Commerce Department showed new-home sales jumped 15.6 percent last month to an annual rate of 437,000, the highest mark since July 2008.

Separately, the Federal Housing Finance Agency reported a 0.6 percent rise in home prices while the S&P/ Case-Shiller home-price index rose 0.2 percent in December, taking fourth-quarter gains to 7.3 percent, the third straight quarter of year-on-year gains.

And the Conference Board’s index showed consumer confidence jumped to 69.0 this month from 58.6 in January, beating forecasts of 62.3 and showing consumers have taken the recent hike in payroll taxes and rise in gas prices reasonably well—so far.

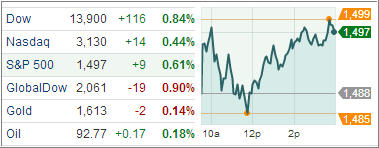

The Dow Jones Industrial Average (DJIA) jumped 116 points and the S&P 500 Index (SPX) rose 9 points with materials and consumer discretionary stocks fronting gains that included all 10 of its major business groups.

Treasury prices fell pushing up yields after Fed Chairman Ben Bernanke defended the central bank’s unprecedented easing measures during a congress testimony, spurring demand for riskier assets.

Yield on 10-year benchmark notes rose from a one-month low after the central bank chief said there is little risk of asset-price bubble or inflation due to monetary stimulus measures, moderating demand for safer assets. US debt witnessed the biggest rally since November yesterday as investors grew wary after inconclusive elections in Italy triggered concern Europe’s debt crisis would intensify.

The US dollar, meanwhile, pushed higher against most of its rivals Tuesday after Fed Chairman Bernanke backed the central bank’s stimulus efforts and a round of upbeat US economic data boosted confidence.

European stocks finished mostly lower as inconclusive elections in Italy and the resulting political deadlock fueled fears of renewed instability in Europe’s third-largest economy.

The Stoxx Europe 600 index slipped 1.3 percent to 284.60 with more than seven stocks on the pan-European gauge retreating for every one that climbed.

Except Ireland and Denmark, national benchmark indexes slipped in all 18 western European markets with Italy’s FTSE MIB index sinking the most, shedding 4.9 percent.

Our Trend Tracking Indexes (TTIs) held steady and settled the day as follows:

Domestic TTI: +2.50%

International TTI: +7.83%

There is bound to be more fallout coming from the elections in Italy, as the result was the exact opposite as what the EU central planners had hoped for; in other words, the Italians are simply fed up with unelected bureaucrats telling them what’s good for them.

Contact Ulli