US equities slipped slightly following the S&P 500 index’s biggest rally in a year as minutes from the Fed’s December meeting showed some policy makers were mulling whether to wrap-up its $85 billion monthly bond purchase program before the end of this year.

What that means is that QE punch bowl addicted crowd may no longer have the Fed to support the relentless and economically disconnected rise of the major market indexes.

Plans were announced to expand the stimulus program in mid-December until the unemployment rate fell below 6.5 percent or inflation exceeded 2.5 percent. Minutes from the latest Federal Open Market Committee showed policy makers are likely to end their monthly bond purchase program sometime in 2013.

Equities rose earlier today after data from ADP Research Institute showed the private sector added 215,000 jobs in December while a separate government report showed first-time jobless claims rose 10,000 to 372,000 in the latest week. However, the exuberance faded as investors turned their attention to the impending confrontations between Republicans and the White House over spending cuts.

Lawmakers may need to approve a hike in the $16.4 trillion debt ceiling as early as mid-February, and Republicans are expected to use the vote to force Obama accept cuts in entitlement programs such as Medicare. Things may come to a head again in early March when the issue of $110 billion in automatic spending cuts come up before the Congress that were “postponed” in the January 1 tax deal.

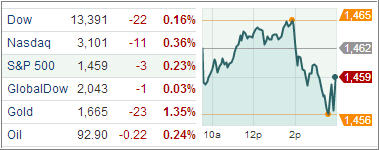

The Dow Jones Industrial Average (DJIA) shed 21 points while the The S&P 500 Index (SPX) fell 3 points with technology and basic materials faring the worst, and healthcare and energy gaining the most among its 10 major industry sectors.

Treasury prices fell for a third day, pushing yields up on the benchmark 10-year notes to a more than seven-month high after FOMC minutes showed some policymakers favored ending the monthly bond purchase program sometime in 2013.

The US dollar meanwhile extended gains Thursday, pushing the euro to a near one-month low after FOMC minutes showed the Fed may discontinue its monthly bond purchase program sometime in 2013, and traders weighed the unresolved issues surrounding automatic spending cuts that have been merely delayed by two months.

European stocks traded mixed today with Frankfurt and Paris giving up some of Wednesday’s big gains, but the region’s benchmark index pushed higher, thanks to a delayed rally in Swiss shares on the back of a US budget deal the fiscal cliff.

Our Trend Tracking Indexes (TTIs) retreated just a bit but remain clearly on the bullish side of the trend line by the following percentages:

Domestic TTI: +2.35%

International TTI: +9.01%

For more details, please see the latest StatSheet, which I will post shortly.

Contact Ulli