It was combination of weak retail numbers, showing that consumers spent less during this holiday season than last year, the ongoing fiscal cliff saga followed by low volume in the markets that provided neither upside ammunition nor any motivation for those left on Wall Street to get involved during the last few trading days of 2012.

It’s no surprise that many shoppers may have stayed away from the stores due to the uncertainty about the fiscal cliff negotiations, which also means that the market indexes will be at best holding on to these levels, but more likely sliding sharply should these issues not be resolved by December 31st.

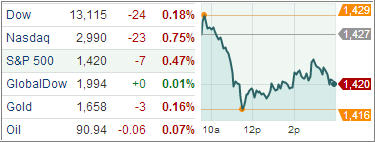

Wall Street’s anxiety index, the VIX, rose and closed above 19 for the first time since early November, while the S&P 500 slipped a modest 7 points to cling on to the 1,420 level. Of course, hope remains for a ‘Santa Claus rally,’ which usually occurs during the last five trading days of the year and the first two of the New Year.

However, much depends on the outcome of the cliff talks, which are scheduled to continue on Thursday. Should the talks fail, some analysts expect an immediate sell off of 3%-5%, which is not a guarantee, but merely an opinion, and a more severe drop is a distinct possibility.

The latest talks now involves a ‘scaled back deal’ on the fiscal cliff with exact details still unknown. Market reaction to any such compromise, or ‘small ball’ bill as it has been called, is wide open. It’s best not to get involved until this circus show finally comes to an end.

Our Trend Tracking Indexes (TTIs) have come off their recent highs with the Domestic TTI now standing at +1.07%, while the International TTI sits at +6.79%.

Contact Ulli