US major indexes finished lower Tuesday after rallying early on as optimism over home improvement retailer Home Depot’s strong results were offset by fiscal cliff worries.

Investors chose to stick to the sidelines, unsure if lawmakers could cut a deal that would stop the onset of sharp spending cuts and tax hikes in January.

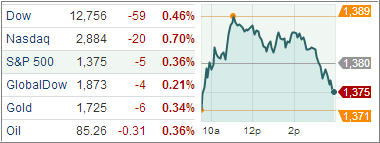

Giving up its early gains, the Dow Jones Industrial Average (DJIA) finished 59 points lower, with most of the sell off coming in the final hour of trading. Breadth within the 30-component blue-chip index turned negative as decliners outpaced winners 24 to 6. The benchmark has now ended up lower in four of the past five sessions.

The S&P 500 Index (SPX) shed 5 points with financials and technology pacing losses and consumer discretionary and utilities gaining the most among its 10 business groups.

Treasury 10-year yields tumbled to their lowest levels in two months as uncertainty over the budget debate in the US and worries over Europe’s sovereign debt crisis spurred demand for safer assets. The benchmark 10-year Treasury yield fell 3 basis points to 1.59 percent while yield on 30-year Treasury bonds dropped 3 basis points to 2.72 percent, also their lowest in two months.

The euro found traction after Greece managed to sell EUR 4.06 billion in 4- and 13-week T-bills to redeem debt obligations that are due Friday, easing fears of an imminent default.

The single currency is still trading near its two-month low levels against the US dollar. The ICE dollar index, a barometer of the greenback’s worth against a basket of six international currencies, edged up slightly.

Meanwhile, European stocks surged higher in a late-session Wall Street-inspired rally, shaking off worries over Greece even though European leaders decided to withhold the nation’s latest bailout money. The Stoxx Europe 600 index finished 0.4 percent higher, snapping a four-session losing streak.

Economic data from the eurozone remained weak with the German ZEW economic confidence index tumbling unexpectedly to -15.7 in November from -11.5 in October.

In a news conference late Monday, leader of the eurozone finance ministerial group Jean Claude Juncker disagreed with IMF managing director Christine Lagarde over debt relief to Greece. The group of ministers granted two more years to Athens, till 2016, to cut budget deficit to 2 percent of GDP. However, a draft report prepared by the IMF, The ECB and the EU, revealed such an extension would mean Greece would require an additional EUR 32.6 billion in funding, according to news reports; and so the saga continues with no concrete solution in sight.

The DAX 30 index however closed marginally higher in Frankfurt, lifted by Deutsche Bank AG as risk sensitive sectors gained across Europe.

The CAC 40 index rose 0.6 percent in Paris after shares of Credit Agricole and BNP Paribas jumped 3.1 percent and 2.4 percent, respectively.

Banks were also on the rise in the UK, lifting the FTSE 100 index higher in London. HSBC Holding Plc gained 0.8 percent while Barclays Group Plc added 1 percent.

In the ETF space, the United States Gas Fund (UNG) was one of the best performers, vaulting 4.81 percent as cold weather across much of US provided boost natural gas prices.

NG futures jumped 4.71 percent to $3.74 per million BTU as speculators kept on piling this commodity hoping cold weather will eat away inventory stockpiles.

The SPDR S&P China ETF (GXC) was one of the biggest decliners, shedding 1.63 percent on the day after news reports suggested the government may extend a property tax trial.

Momentum continues to be weak as our Trend Tracking Indexes (TTI) headed closer to their trend lines, although the move was modest today. Here’s how we ended up:

Domestic TTI: +0.64%

International TTI: +1.37%

For quick access to the most recent StatSheet including TTI charts and all momentum figures, click here. You can read the latest ETF Model Portfolio update here.

Disclosure: No holdings in ETFs discussed above

Contact Ulli