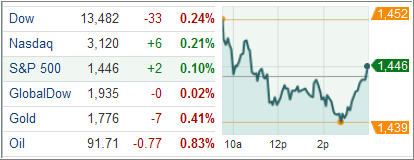

The major indexes finished mixed today with the Dow Jones Industrial Average sinking for the first time in three days after Spanish Prime Minister Mariano Rajoy contradicted a previous Reuters report that said the country could seek help from the European Union as early as this weekend.

The Dow Jones Industrial Average (DJIA) closed 33 points lower, recovering from a steeper 90-point drop. 19 of the 30-component blue-chip index ended lower as breadth turned negative on a choppy trading day.

The S&P 500 Index (SPX) managed a modest 2 point gain on a last hour rebound to finish on the plus side with utilities and healthcare outperforming and materials faring the worst among its 10 business groups.

Treasuries hit a near one-month high as investors sought refuge in safe haven after Spanish Prime Minister Mariano Rajoy dismissed media reports the country may seek a full-fledged bailout shortly.

Reuters had previously reported quoting unnamed European officials that the Iberian nation is close to formally seek help though Berlin has signaled to Madrid to hold off as it believed the country was on course to repair the shortcomings and may not need a bailout. That would have to go down as the joke of the day.

The yield on the benchmark 10-year Treasury notes dropped one basis point to 1.62 percent while 30-year Treasury bond yields also fell one basis point to 2.81 percent.

Meanwhile, the US dollar trimmed losses against the 17-nation euro after Spain’s refusal to seek a formal bailout from the EC. The ICE-dollar index, a gauge of the greenback’s strength against a basket of six currencies, bounced off the session low of 79.479 to 79.735, still slightly off from late Monday’s 79.796.

Across the Atlantic, banks weighed on European investors as markets grappled with conflicting reports over Spain seeking a formal bailout. The Stoxx Europe 600 index slipped 0.3 percent as Rajoy decided to buy more time to weigh the terms set by the ECB.

Spanish 10-year bond yields dropped 13 basis points to 5.75 percent after Rajoy trashed media reports of an imminent bailout request after meeting 17 leaders of Spain’s regions.

Separately, data showed the country’s jobless rate rose 1.7 percent in September. Madrid already has the highest unemployment rate in European Union. Also bonds worth EUR 16 billion will be due for redemption by the end of this year even as the country’s five of the most indebted regions have sought help from the central government.

Spain remains one huge mess, and it’s only a matter of time before they will have to get real and ask for a bailout, which will then put them on the same path as Greece. It makes me wonder how long it will take for countries to realize that the best option is to default, go back to their own currency and start rebuilding.

Contact Ulli