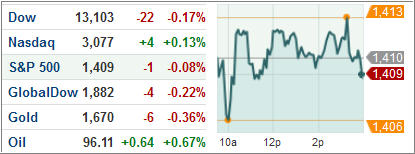

US blue-chip stocks closed lower Tuesday while the NASDAQ composite finished in the green to extend gains for the second straight session as investors cheered better-than-expected housing data even as consumer confidence plummeted ahead of a potentially market-moving speech by the US Fed chairman later this week.

The S&P/Case-Shiller index that surveys home price across 20 cities and covers about 80 percent of the US housing market showed a 6.9 percent gain in the second quarter, beating analysts’ estimate of a 0.3 percent decline.

The US dollar declined Tuesday as hopes of more quantitative easing faded after European Central Bank President Mario Draghi cancelled his scheduled speech Saturday at the global central banker’s economic symposium in Jackson Hole. The dollar index, a barometer of the greenback’s strength against a basket of six global currencies, fell to 81.334 from Monday’s reading of 81.696.

The benchmark 10-year Treasury rose for the second day, pushing yields down to the lowest in almost three weeks, as the August Conference Board consumer confidence index reading tumbled, marking the worst since November. Yield on ten-year Treasury notes dropped two basis points to 1.64 percent while yield on 30-year Treasury bonds shed two basis points to end at 2.74 percent.

Meanwhile, European stocks finished lower Tuesday on growth worries after Spain’s National Statistical Institute said the country’s Q2 GDP shrank 0.4 percent over the prior quarter and Japan cut its growth forecast for the first time in 10 months. The pan-European Stoxx Europe 600 index lost 0.7 percent, wiping off Monday’s 0.5 percent gain following reports that Spain’s most indebted region Catalonia will ask for a EUR 5.02 billion bailout from Madrid.

The Spanish IBEX 35 index tumbled 0.9 percent as waning expectations of more stimulus from central banks coupled with a worsening Spanish debt situation triggered a selloff.

Germany’s DAX 30 index skidded 0.6 percent despite market research group Gfk’s forward looking consumer sentiment index coming in at 5.9 points, beating expectations of a 5.8 point gain.

In the ETF space, the Barclays iPath Dow Jones-UBS Cocoa Total Return Sub-Index ETN (NIB) surged 4.75 percent as cocoa futures rose two percent to $2603 a ton. NIB has soared 19 percent in the past three months while agricultural commodities rose 14 percent.

Persistent dry weather in West Africa and production issues in Ivory Coast are expected to keep supply constrained. Wind power-linked ETFs rose after Danish wind turbine manufacturer Vestas Wind Energy announced it is in talks with Japan’s Mitsubishi Heavy Engineering for possible capital injection.

While shares of Vestas jumped 18.52 percent in Copenhagen, the First Trust ISE Global Wind Energy ETF (FAN) and the PowerShares Global Wind Energy Portfolio (PWND) rallied 2.91 percent and 2.30 percent, respectively.

The WisdomTree Japan Hedged Equity Fund (DXJ) was one of the biggest decliners, shedding 1.06 percent on the day after Tokyo lowered its GDP growth target for 2012 citing worsening European economic condition.

All eyes are now focused on Ben Bernanke’s speech from Jacksopn Hole this coming Friday. Expectations for more QE are high, and any disappointment may pull the major indexes off their high levels, especially after the Holiday weekend once Wall Street again is fully staffed and ready to push buy/sell triggers.

Disclosure: No holdings

Contact Ulli