The Latin American countries have survived last year’s down-turn rather well and, after little slippages, the growth engines are humming again. The latest IMF report is rather upbeat about the Latin American and Caribbean economies and expects them to pick up pace following a slight slowdown in 2012.

You should, however, remember that these economies are heavily dependent on commodity exports and their growth depends on global economic environment. The Chinese economy has been the major driver for growth for these countries and China is showing signs of a slowdown. Nonetheless, if Western economies pick up, the long term outlook for this region remains attractive.

Among Latin American countries, Brazil and Columbia remain attractive so let’s look at some details:

Brazil: iShares MSCI Brazil Index Fund (EWZ)

The International Monetary Fund expects Brazil to grow at 3 percent in 2012 and 4.1 percent in 2013.

With inflation coming down to 5 percent, the central bank cut interest rate to a two-year low of 9 percent to stimulate growth. The GDP grew at 2.7 percent in 2011, a sharp fall from 7.5 percent in the previous year. Brazil is rich in natural resources and China remains its one of its biggest markets. However, with a low unemployment rate of 6 percent, a growing middle class and rising salaries, the country’s domestic demand growth continues to impress.

EWZ tracks MSCI Brazil Index and with $8.71 billion in assets, it has emerged as the biggest Latin American fund. The fund holds 81 equities that trade in Brazilian markets and has the highest holdings in financials, materials and energy respectively. The fund has an annual operating expense ratio of 0.59 percent and returned 13.4 percent in the first quarter of 2012. The fund has returned 13.7 percent annually on an average since its inception in July 2000, though it had a forgettable year in 2011, returning -22.3 percent.

While the fundamentals are usually shown in a positive light, the current major trend paints a different picture as the 1-year chart from YahooFinance shows:

Momentum has clearly reversed since the middle of March, but I could see a new entry point, if you currently don’t have a position, once the long term trend line is pierced again to the upside. You can find the exact momentum numbers in my weekly StatSheet.

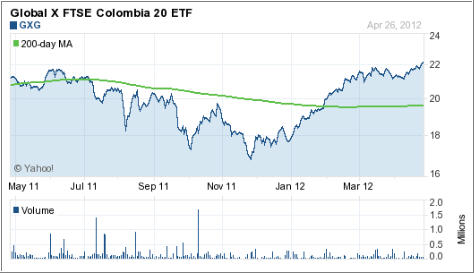

Colombia: Global X FTSE Colombia 20 ETF (GXG)

The Colombian economy has been growing at over 4 percent since 2004 except for 2008 and 2009 due to the global crisis. The latest IMF report projects an annual growth of 4.7 percent in 2012 and 4.4 percent in 2013.

The country is endowed with huge oil reserves and crude production has nearly doubled over the last few years. Inflation have started to stabilize after the central bank increased rates last year and early this year, prompting the bank to keep rates unchanged at 5.25 percent in its March meeting.

Columbia, however, lacks developed infrastructure, and suffers from high unemployment rate (10.8 percent) and income inequalities. Drug trafficking also remains a tough challenge for the government for a long time now.

GXG tracks the FTSE Colombia 20T Index which is a market capitalization weighted index of the20 most liquid stocks in the Colombian equity market. Since its inception in Feb 2009, the fund has returned nearly 200 percent and charges 78 basis points annually. Total assets under management (AUM) are $168.9 million and materials (26 percent), financials (21 percent) and energy (14 percent) are the top holdings.

A look at the chart shows a far better picture than with saw above with EWZ:

The uptrend has been clearly established, and GXG is firmly entrenched on the bullish side of the line. If you decide to seek exposure, be sure to use my recommended trailing sell stop discipline to limit downside risk. For country ETFs such as this one, I recommend 10%.

Disclosure: Holdings in EWZ

Contact Ulli