In case you missed it, here’s a summary of the ETF topics and market reviews I posted to my blog during the week ending on 3/18/2012.

Last week’s overhead resistance was overcome as the Dow and the S&P 500 cleared their respective hurdles of 13k and 1,400.

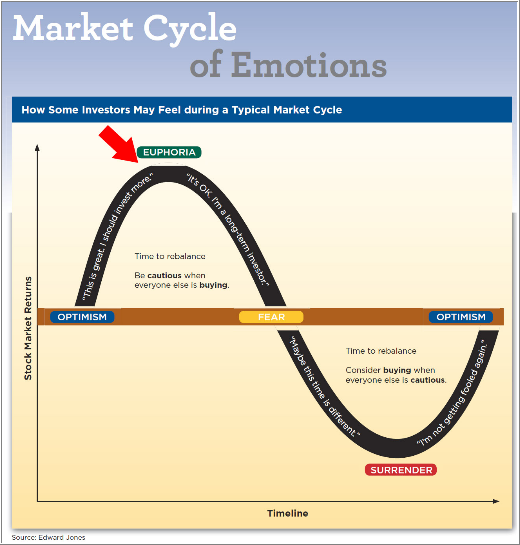

That brings up the question as to how much higher can we go and where in the cycle might we be?

ZeroHedge featured this chart showing that, as market euphoria increases, we may be closing in on the top:

[Click on chart to enlarge]I agree with where we might be at this particular point in time, but our Trend Tracking Indexes (TTIs) will eventually confirm once we have reached and passed that top.

This week, we covered the following:

Fixed-Income ETFs Are Getting A Lot Of Attention, What’s The Reason?

Not Sure If The Bull-Run Is Fundamentals Driven? Here’s How You Can Hedge With ETFs

ETF/No Load Fund Tracker Newsletter For Friday, March 16, 2012

Weekly StatSheet For The ETF/No Load Fund Tracker Newsletter – Updated Through 3/15/2012

Major Market ETFs Gain On Strong Economic Data; GAZ Gains, SCIF Tanks

US Stock ETFs End Mixed; TBT Jumps, GDXJ Sinks

7 ETF Model Portfolios You Can Use – Updated through 3/13/2012

Major Market ETFs Rally On Better Retail Sales Data; URA Rises, VXX Sinks

Equity ETFs Remain Range-Bound As Investors Remains Skeptical; CORN Grows, KWT Flickers

ETFs/Mutual Funds On The Cutline – Updated Through 3/9/2012

Contact Ulli