ETF/No Load Fund Tracker Newsletter For Friday, February 24, 2012

ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, February 24, 2012

MAJOR MARKET INDEXES END WEEK HIGHER, ENERGY LINKED ETFS SHINE AS CRUDE PRICES INCH HIGHER

Wall Street stocks ended the week higher on Friday as better-than-expected economic data continued to flow in. The enthusiasm was somewhat tempered, however, as oil prices breached the $109 barrier amid tensions over Iran’s nuclear program.

The University of Michigan Consumer Sentiment Index came in at 75.3 for Feb., topping expectations of 73 for the month. New-home sales number, although higher than last month’s reading, fell short of estimates, indicating that the housing market is not out of the woods yet.

The Dow Jones Industrial Average (DJIA) failed to clear the psychologically important, but technically irrelevant 13,000 level again today. The DJIA lost about two points, or less than 0.1 percent, to end at 12,982.95. The Dow has been trading at its highest level in nearly four years since the start of February.

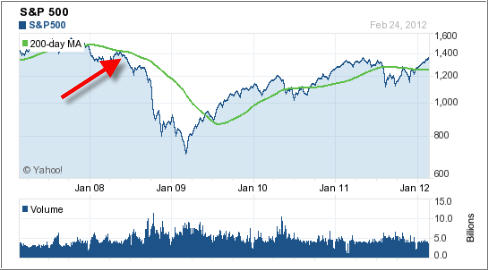

The S&P 500 added 0.2 percent, to close at 1,365.74 for the day. It’s up 0.3 percent on the week, holding just below its June 2008 high. While that sounds great as a news headline, the gains of the last few years have done nothing but erase the devastating losses of the 2008 market crash as the chart shows:

[Chart courtesy of YahooFinance]Our Domestic Trend Tracking Index (TTI) signaled a ‘Sell’ on 6/23/08. Had you followed it and done nothing since, you’d be at same point as those investors who held their positions through stunning pullbacks and breathtaking rallies. Ah well, the benefit of hindsight…

The Domestic TTI ended the week on the bullish side of the trend line by +5.74%, while the International TTI rallied to +5.19%.

Yields on 10-year Treasury notes fell to a fresh weekly low of 1.98 percent as worries over rising oil prices impacting growth lingered.

The central bank purchased longer-term securities maturing between Feb. 2036 and August 2041 today, a move aimed at replacing $400 billion of shorter-term debt to cap future borrowing costs.

Crude prices hit a nine-month high with oil futures rising $1.94 to $109.77 a barrel on the New York Mercantile Exchange over saber rattling with Iran.

I am sure you’ve noticed the tremendous price change at the pump, however, rising energy prices is proving to be a boon for energy producers. Market Vectors Russia ETF (RSX), a Russia focused equity ETF with nearly 40 percent exposure to producers like Gazprom and Lukoil, rose 4.5 percent today (No holdings).

Also iShares MSCI Europe Financials Index Fund (EUFN) added an impressive 1.5 percent on the week (No holdings). The region’s stability in the near-midterm remains a worry though.

Have a great week.

Ulli…

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Chris:

Q: Ulli: I have been tracking your system for a few months now. I find it very intriguing, and recently started to invest in this manner, to lock in gains, and limit losses.

My question involves how you handle dividends. I realize that you adjust your trailing stop based on the distribution, however, in your portfolios, do you take a cash distribution, or do you use dividend reinvestment? How would you handle a new trailing stop with dividend reinvestment, if in fact you use that method?

Any advice would be greatly appreciated.

A: Chris: I always take a cash distribution, which I let accumulate and then, once the sum is meaningful, I re-invest. In taxable accounts, it eliminates tedious cost basis calculations of re-invested dividends.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli

Comments 2

Ulli

In today’s (2/24/12) column, you made the statement, “Our Domestic Trend Tracking Index (TTI) signaled a ‘Sell’ on 6/23/08. Had you followed it and done nothing since, you’d be at same point as those investors who held their positions through stunning pullbacks and breathtaking rallies.” My question is, which of those selections would have been better for the individual investor, and why?

Doug,

From my viewpoint, avoiding the downturn was far more important. Things looked pretty dire back then, and the S&P needed over 3-1/2 years to get back to the break even point. Next time, we may not be as fortunate, given a current worse economic environment.

Ulli…