In conjunction with abnormally warm winter weather across the nation, markets have followed suit. So far this month, the S&P 500 has gained 4.6% while the NASDAQ has performed even better, returning nearly 7%.

Although I doubt that this current hot streak will carry on long-term, there are certainly some short-term opportunities to capitalize on some attractive equity ETFs while holding on to a sizeable portion of bond ETFs.

Over the last few months, we’ve been maintaining a selective buy target on domestic/sector ETFs and a sell target on international ETFs. This has been beneficial as the Domestic TTI has been in the green while our International TTI remains in the red.

As seen in our most recent domestic ETF cutline report, domestic ETFs have done quite well over the last couple months, especially the industrials sector, with double digit returns in the short-term and above their moving averages. However, as seen in the international ETF/mutual fund cutline report, many foreign ETFs are still below their moving averages despite recent gains.

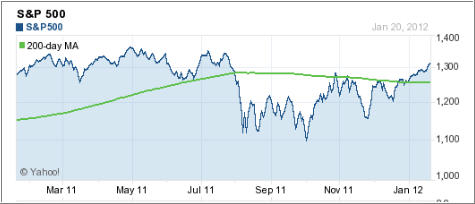

Already this year, the S&P 500 is well above its trend line (see below) and barring a severe drop, should remain above its moving average in the short-term.

Chart courtesy of YahooFinance

While the U.S. is by no means immune to Europe’s problems, the overseas financial landscape faces a greater uphill battle, more openly exposed to negative European developments. The rush to U.S. Treasuries over the last couple months, pushing the 10-year yield below 2%, is a testament to the fact that the U.S. is viewed as a safe haven during periods of high global volatility.

Although some might argue that the U.S. is heading down the wrong path through fiscal stimulus despite a debt-to-GDP ratio near 100%, it’s providing a temporary boost so that the U.S. doesn’t follow Europe’s path (yet). At least we have an independent monetary system where interest rates can be kept very low without having to worry about the fiscal and monetary concerns of others.

In the wake of the financial crisis, the U.S. is one of only 3 countries to have decreased its debt-to-GDP ratio. Although the U.S. has its fair share of unemployment and housing woes, this trend is encouraging especially when most Eurozone countries are still heavily bogged down in debt despite austerity measures.

Europe still has to adequately recapitalize its banks to the tune of nearly $150 billion while the ECB has been sending out lifelines to European banks in the form of 3-year long-term refinancing options (LTROs). And the spillover effects into emerging economies are also significant, especially in Eastern Europe and Latin America, which are heavily dependent on lending from European banks.

Furthermore, the process of Eurozone members getting their fiscal houses in order comes at a steep cost. As alluded to in a recent article by Yale economics professor Robert Shiller, titled Does Austerity Promote Economic Growth?, the evidence suggests that countries instituting austerity measures endure economic weakening. As we’ve already seen in Spain, Italy, and Portugal among others, efforts to minimize long-term debt through austerity are already putting the dampers on economic growth, which could further hamper financial markets in Europe.

I’m not saying the U.S. will provide stellar investment returns in the short run. High unemployment, weak housing, and wage stagnation continue to hold the economy back. And in the long run, emerging economies will likely offer some solid investment opportunities that the developed world may not. But at a time when the goal is not to lose your shirt, the fundamentals favor the U.S.

Contact Ulli