The markets picked up a little upward momentum since last week’s issue with the S&P 500 gaining about 1.5%. The seven ETF Model Portfolios increased in value as well.

All eyes continue to focus on Greece and whether a suitable haircut with bond holders can be worked out. Looks to me that Greece is finally playing hardball as the possibility of a default looms large.

Closer to home, traders will be focusing on the Fed and its FOMC rate decision, which is to be released tomorrow. No changes are expected.

Take a look at the latest ETF Model Portfolio update:

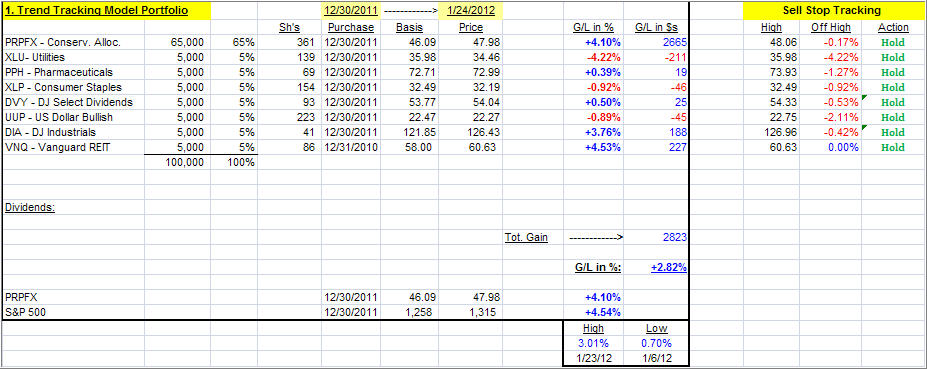

1. ETF Trend Tracking Model Portfolio

[Click on any table to enlarge]This is the portfolio allocation I have used predominantly in my advisor practice during the first half of 2011. Given current market conditions, and an ever growing number of global hotspots, I like the concept of having a solid core holding in PRPFX, although we got stopped out in 2011 as a result of the wild market swings along with a sharp pullback in the metals.

Around this fund, when in buy mode, I add what I call boost components consisting of ETFs that can produce higher returns than my core holding, at least during bullish periods. When a market pullback occurs, the core holding should add an element of stability.

Nevertheless, as you know from my writings, anything I invest in involves the use of trailing sell stops, which are shown and tracked on the upper right of the table.

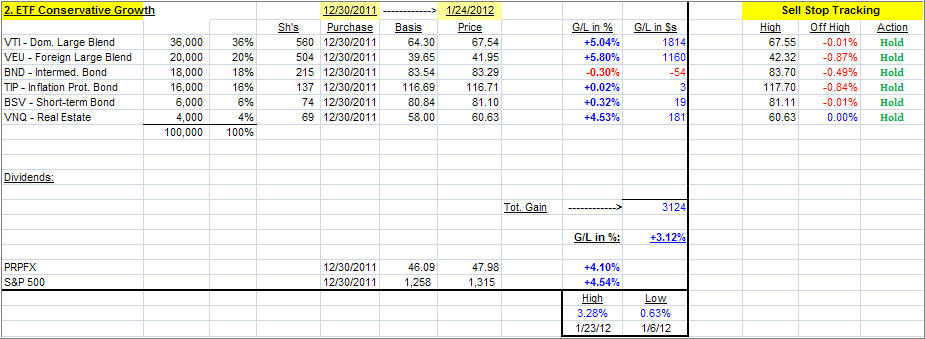

2. Conservative ETF Growth Portfolio

This portfolio, as are the following ones, would be typical of what is being used in the buy-and-hold community, as you can see by the 40% allocation to various bond ETFs. If you are conservative, this simple combination could work for you, but I still recommend the use of the trailing sell stops during these uncertain times.

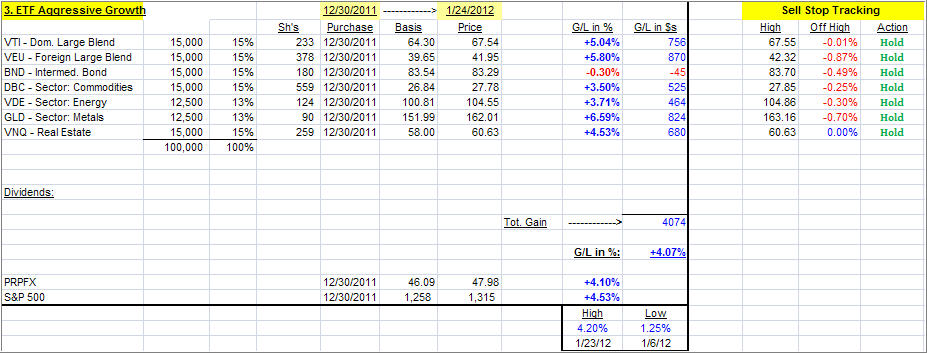

3. Aggressive ETF Growth Portfolio

What makes this one aggressive is the small 15% allocation to bonds. If you have an aggressive streak in your personality, you could consider this one. If you use my recommended sell stop discipline, you know exactly ahead of time what your downside risk will be.

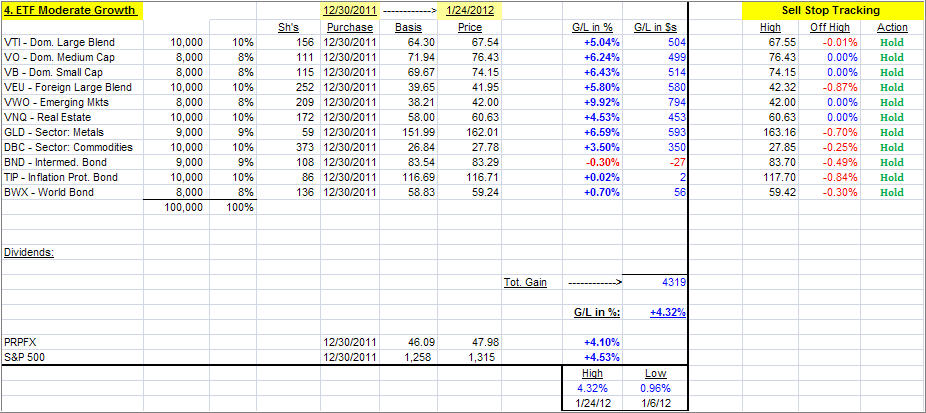

4. Moderate ETF Growth Portfolio

I call this one moderate growth, because of the higher allocation to various bond ETFs (27%) than in the aggressive set up above. It is also more diversified domestically.

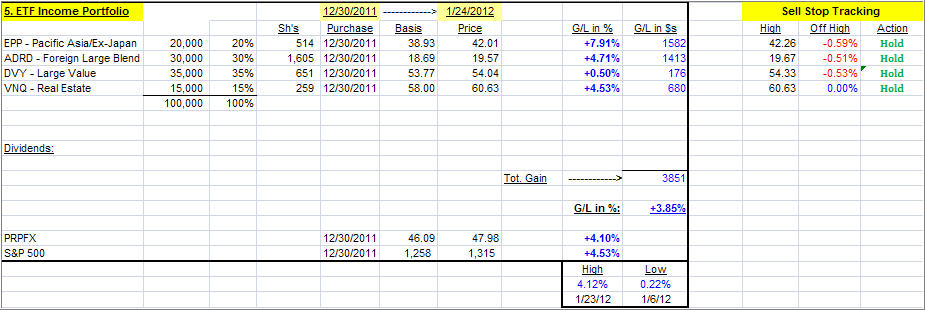

5. ETF Income Portfolio

This is as simple as it gets, but during last year’s sell-off, it dropped in value quickly due to no offsetting bond positions and showed a 0% invested balance by August 2011.

It’ll be interesting to see if this simple combination can withstand the vagaries of the market place in 2012.

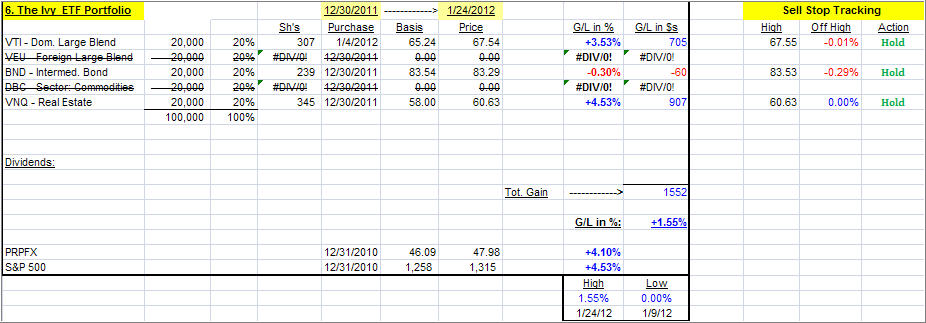

6. The Ivy ETF Portfolio

If you missed the recent post about the Ivy portfolio, you can read it here.

This is a simple 5-asset class portfolio with each individual component being bought when it crosses its respective trendline to the upside. Each component is being sold once it crosses its trend lines to the downside again, according to the author’s rules.

I have made 3 adjustments:

1. I apply a 39-week Simple Moving Average (SMA) to generate the Buys, while the authors use a 45-week SMA.

2. As mentioned in the blog post, I prefer using my trailing sell stop discipline for my exit strategy.

3. Personally. I favor using BND (as opposed to IEF) as my bond component, since it has shown more stability in the past.

Currently, only 3 out of the 5 components are positioned above their respective long-term trend lines and therefore in bullish territory. Should upward momentum improve, we may get to a 100% invested position.

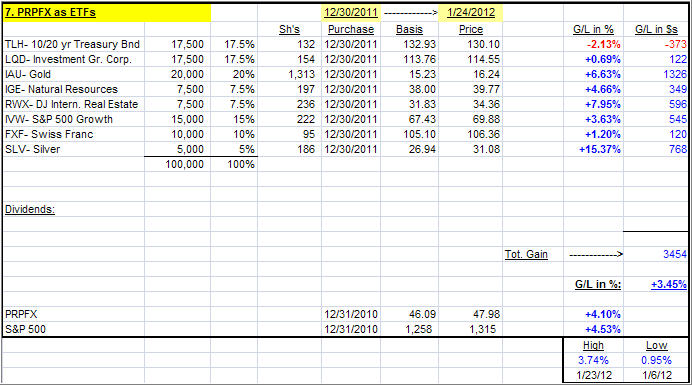

7. The ETF Equivalent of PRPFX

As posted recently, I have created and back tested the ETF equivalent of my favorite mutual fund, PRPFX, which is a core holding in my #1 Portfolio. If you missed it, you can read the announcement here.

Take a look at the combination of ETFs:

Since these 8 ETFs represent only one fund, namely PRPFX, we need to apply a different exit strategy. For that purpose, I will not track the high points made for each ETF, as with the other 6 models, but measure my 7% drop from the high point this entire portfolio has made.

(ETF trading costs are not included in these portfolios demonstrations. They are intended to show market effects on different scenarios only as an educational tool)

To repeat, the key to selecting a portfolio from the above list is not just performance. Personally, I’d rather lag a little on the upside but have some assurance that I will also lag when the downside comes into play.

I will update these portfolios every Wednesday.

Quick Reference:

Disclosure: I may have client holdings in some of the funds/ETFs discussed above

Contact Ulli