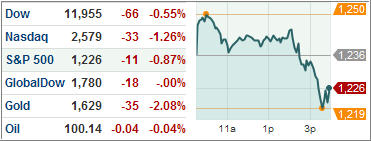

The situation in Europe remains a drag on equity ETFs as markets fell further once more. The S&P edged down 0.85%. The NASDAQ has also been in quite a slump in comparison to the S&P 500 and Dow Jones index, dropping 1.26%. The 10-year Treasury also fell once more, dipping to a yield of 1.96%.

Most notably, the Euro continues to depreciate against the dollar, now hitting $1.30/Euro, its lowest point since January of this year. Although volatility was essentially flat today, there aren’t many positive telling signs that markets will swing into bull territory any time soon.

Evidence that agreement in Europe is quite hard to come by, Merkel dismissed the idea of increasing the size of the European Stability Mechanism (ESM), Europe’s permanent rescue bailout fund. Merkel balked at suggestions of combining the EFSF and ESM given the inability to leverage the financial firepower of the EFSF. In essence, little has been resolved despite the EU summit.

In relation the U.S. economic landscape, Bernanke indicated that the Fed would not yet pursue a further round of quantitative easing. He suggested that the U.S. economy is currently growing at a moderate rate but that European turmoil continues to pose a serious risk.

Meanwhile, the EU treaty has become mired in issues of fine print. Uncertainty lingers as to how binding the treaty is and whether the treaty could create major conflicts as to how national governments conduct their own financial policies. This is especially pertinent for EU members who aren’t part of the Eurozone, thus having their own monetary policy autonomy and not wanting to cede control. To put it mildly, I see more political turmoil in the cards.

Another interesting twist in the Eurozone debacle is the upcoming expiration of collateralized loan obligations (CLOs), which are investment vehicles that purchase private equity loans. However, the current tight lending environment will make it difficult to create new CLOs or refinance pre-existing leveraged loans, which currently exceed $325 billion, possibly adding further pain to the financial system.

Some positives for today were greater than expected demand in today’s Spanish bond sale and improved investor confidence in Germany. Also, U.S. retail sales increased for the sixth straight month although holiday spending may have contributed to this seasonal upward blip. But this information must be taken with a grain of salt as it pales in comparison to the scope of the problems at hand.

Like I’ve alluded to previously, significant financial risks still abound in global markets. Employing a low risk ETF approach is the most prudent course of action until we see widespread improvement.

In terms of trends, our Domestic TTI (Trend Tracking Index) retreated but remains +1.73% above its long-term trend line, while its international cousin slipped deeper into bear territory to a level of -8.40%.

The number to watch is the S&P 500’s 50-day moving average which, if broken, can lead to more selling. The S&P 500 closed today at 1,225.73, which is only +0.47% above the average.

Contact Ulli