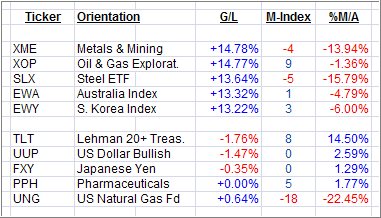

Here is a quick ETF review of the past week’s Leaders and Laggards from my High Volume ETF Master list:

Last week’s euphoric rebound, with the S&P 500 gaining some 7%, did nothing to solve Europe’s problems. It barely made up for the prior 2 week 8.3% drop in the index. In the end, nothing was gained other than some reversals in the Leaders and Laggards columns.

Case in point is the Steel ETF (SLX), which got hammered the prior week at a rate of -10.27%, only to rebound +13.64% with no changes in fundamentals.

We have seen over the past few months that Leaders and Laggards go into reverse mode based on the mood in the market place. That represents a total lack of direction.

If you consult some of my other data points like the M-Index and the %M/A column, which shows how far above or below its respective trend line an ETF is currently located, you can see that this week’s Leaders are very likely short-lived as they remain stuck on the bear market side of the trend line.

On the other hand, some of this week’s Laggards, with the exception of UNG, have been fairly steady during the market turmoil of the past few months by having remained above their trend lines.

The lesson is that this week’s gainers can turn into next week’s losers, so stick to those ETFs that have shown some bullish behavior and some ability to withstand sharp sell offs.

My weekly StatSheet is designed to give you an assist in making better ETF/Mutual Fund selections.

Disclosure: Holdings in TLT

Contact Ulli