The ETF/No Load Fund Tracker—Monthly Review—November 30, 2011

To put it mildly, November has been a topsy-turvy month for global markets. Although the S&P 500 only dropped 0.7% during the month, it was saved from a potentially disastrous monthly performance due to seemingly unjustified exuberance in the last few days of the month after a couple rough weeks.

Despite some appreciation in equities toward the end of the month, there is still a significant amount of volatility in the market given continued uncertainty about Europe’s bailout plans and signs of the contagion spreading. High bond yields in excess of 7% in Italy and Spain have exacerbated the debt crisis, increasing the probability of Eurozone disintegration.

With the exception of international equity ETFs and some bear market funds, I’m still adhering to my buy signal on a relatively selective basis depending on the attractiveness of certain ETFs. But in light of this volatile environment, I’ve still maintained a consider bond ETF allocation in addition to some PRPFX. With the negativity surrounding Europe and little improvement in the U.S., the key is to have a primarily defensive strategy in case the market’s bottom falls out.

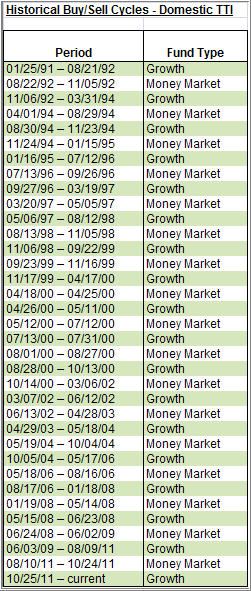

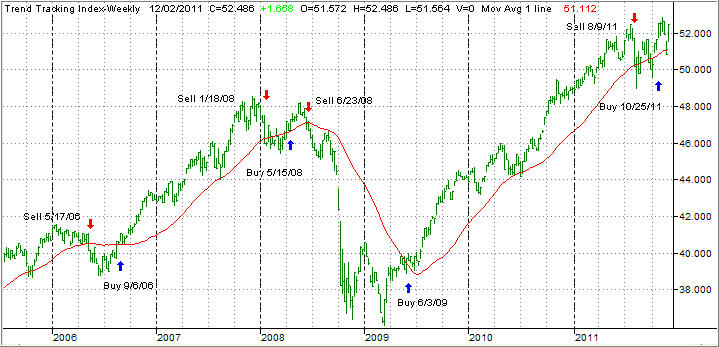

Nevertheless, our Domestic TTI (Trend Tracking Index) finished the month above its long-term trend line at +2.64%, after briefly sinking below it, warranting some select equity ETF exposure where deemed appropriate. See chart below:

[Click on chart to enlarge]As far as equity ETFs, we are sticking to Consumer Staples Select SPDR (XLP), which has held up relatively well as it isn’t as sensitive to major market movements.

This week’s coordinated action among major central banks provided some much needed liquidity to Europe’s banks, offering some short-term optimism. However, it can’t hide the fact that the European banking system is still under major duress while governments need ECB intervention to keep bond yields from spiraling further out of control. Even Germany, the beacon of hope for the Eurozone, faced difficulties selling bonds last month.

Furthermore, it has been doubtful whether the EFSF can be leveraged to the level it needs to provide sufficient aid to ailing countries. While Greece is a basket case that needs to exit the Eurozone, the possibility of a disorderly default in Italy and perhaps Spain would create a market pandemic.

In the case of Italy, debt restructuring in the vein of Greece’s bond haircut has been thrown around as a serious option given the futility of austerity measures.

To get a clearer idea of where the Eurozone is headed, we’ll be looking to the EU summit on December 9. Hopefully, there will be some resolution regarding Greece’s fate and efforts to obtain external bailout funding seeing as the Eurozone has proven unable to help itself.

And while Europe’s stuck in a rut, the U.S. situation isn’t much better. Weak housing data and mixed jobs numbers are pushing the need for additional quantitative easing as suggested by some members of the Fed. Plus, the political deadlock from the “Supercommittee” regarding the budget deficit has only worsened the situation.

Though global markets may have been somewhat impervious to the threat of contagion at times, Asian and emerging markets are especially susceptible to a Eurozone meltdown. A market dive can severely hamper these regions that are reliant on European banks for a considerable percentage of loans and other types of crucial funding.

As seen towards mid-to-late November with greater demand for U.S. Treasuries, we may see investors taking refuge in U.S. government bonds if Europe can’t reverse its fortune. Not to mention, the Euro mildly depreciated against the dollar in November if that’s a telling sign.

Currently, there is little to no indication as to where markets will trend on a week to week basis. Yet, the long-term picture suggests a period of significant adversity on a global scale despite our Domestic TTI still hovering in bullish territory.

Thus, the focus is to protect ourselves from an impending steep drop. Having a disciplined trailing sell stop strategy is an effective and efficient way to achieve this goal.

Contact Ulli