Europe is going through turbulent times, but markets didn’t seem to care as the S&P 500 rose 1.17%. Other indices such as the FTSE and DAX also ended in the green. However, these weekly up and down swings are disconcerting as markets quickly transition between risk on and risk off modes.

Confirming my concerns, Italy is now stuck in a very tight spot politically. Berlusconi failed to reach a majority in yesterday’s budget vote, heeding calls for him to step down in order to prevent a potential market panic. The plan is for him to bid his “Arrivederci” once an austerity budget is passed.

An indication of escalating borrowing costs, Italy’s 10-year bond hit a high of 6.77%, highlighting a real risk that Italy won’t be able to pay off its debt. As a larger economic force, a financial meltdown in Italy could trigger greater widespread contagion throughout Europe. Whether Italy has the political will to muster a turnaround remains to be seen, despite the perceived optimistic investor sentiment seen today.

Considering the rapid political change that Europe is undergoing, another big dip is highly likely. As Greece and Italy head on a steep downward trajectory, Spain and Portugal may soon be next. Spain is especially hurting right now given its rising bond yields and record high unemployment north of 20% that has served as a fiscal drain. This might force Spain to seek a bailout soon if the situation worsens.

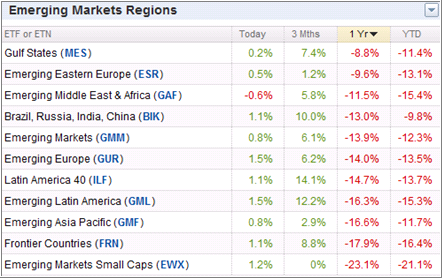

Furthermore, concerns regarding how frictions in European credit markets could impact emerging market ETFs were highlighted today by Financial Stability Board chairman, Mark Carney, as well as HSBC CEO, Stewart Gulliver, the latter of whom highlighted the possibility of an Asian credit crunch if Europe bank liquidity dries up. The Bank of International Settlements reported that as of Q2 2011, 21% of Asian international bank loans ex-Japan came from European banks.

To track how emerging market ETFs have performed this year, please see the following table:

With Papandreou gone and Berlusconi on the verge of getting shown the exit, I wonder which prime minister will be next.

For now, I stress the importance of sticking to a strict stop loss sell strategy if we hit another bump in the road, which really isn’t a matter of if, but when. At this time, selective equity exposure backed by a low-risk bond ETF/cash position is the prudent course of action.

Contact Ulli

Comments 1

Just a quick note to express my appreciation for all the information you provide and for your level- headed commentary…………Thanks, Ulli!

Bryan