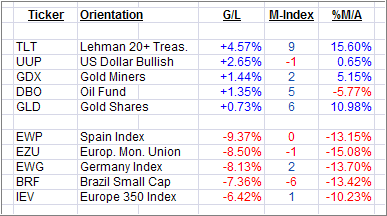

Here is a quick ETF review of the past week’s Leaders and Laggards from my High Volume ETF Master list:

With the markets having pulled back sharply during the first two trading days of this week, this week’s top 5 Leader and Laggards listings more accurately reflect the current state of affairs, at least to my way of thinking.

With the Eurozone being pretty much out of control in regards to the debt crisis, the Laggards are, to no surprise, all Europe indexes with the exception of Brazil. Please note the sharp losses for the week along with the negative %M/A figures, which represent how much each ETF is positioned below its respective long-term trend line and therefore in bear market territory.

On the Leaders side, TLT has moved into the #1 spot again, as flight to safety ranked as a priority. At the same time, UUP has shown signs of life by sneaking back above its long-term trend line, although by only a meager +0.65%. UUP has been doing the trend line dance since September, but a recent clear break was rebuffed as hype and hope about a permanent Eurozone solution pushed the major indexes higher and pulled the dollar lower.

News driven volatility and sudden directional changes are bound to stay with us until a real solution to the European debt crisis has been found and implemented. Judging by the endless meetings and continuous jawboning without any tangible agreement, I see a debt default as a far more likely possibility in the future.

Disclosure: Holdings in TLT

Contact Ulli