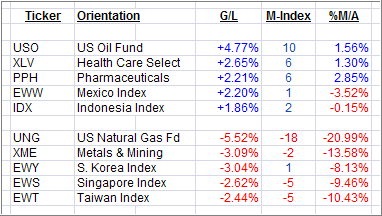

Here is a quick ETF review of the past week’s Leaders and Laggards from my High Volume ETF Master list:

Another roller coaster week shifted things around in the winners and losers columns. It’s interesting to note that, despite the equity ETF comeback of last two trading days, none of them gained enough to make it into the Leaders column.

Sector ETFs were the primary gainers, some of which just crossed their long term trend lines to the upside as the %M/A column shows. Along with positive M-Index rankings, they may be worth your consideration. I will post the corresponding updated High Volume ETF Cutline list on Monday morning, so that you can better evaluate those ETFs that have jumped into bullish territory.

Country ETFs were a mixed bag this week, as two of them made into the Leaders column, while three of them ended up on the losing side. Again, to be certain that upward momentum is rising, you want to enhance your odds of success by making sure that the %M/A column is positive; it shows the percentage an ETF has climbed above its trend line (positive number).

The idea here is not to engage in bottom fishing but to catch ETFs as they come out of the basement and cross the dividing line between bullish and bearish territory to the upside.

Disclosure: No holdings

Contact Ulli