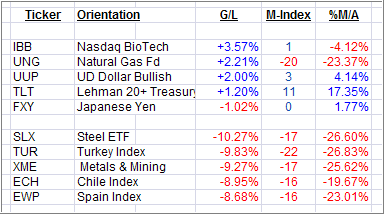

Here is a quick ETF review of the past week’s Leaders and Laggards from my High Volume ETF Master list:

Another horrific week, as the major indexes got hammered again with the S&P 500 losing some -4.7% despite the Thanksgiving holiday reducing the actual trading days to four.

Europe was front and center again, and the U.S. market was not able to separate itself from the events and daily EU headlines. The latest major agreement was that leaders will no longer engage in public bickering; well, let’s see how long that one holds…

On this week’s Leaders list, a couple of sector ETFs moved to the top (IBB and UNG), but the momentum numbers are not confidence inspiring, which supports my view that being out of equities at this point is a wise decision.

That is not only supported by the threat of more serious debt contagion in Europe, but also by the fact that our Domestic Trend Tracking Index (TTI) has reversed course and is peeking into the abyss called bear market territory.

On the Laggards side of the above matrix, things could hardly be worse, as the five listed candidates are not even close to showing positive momentum and remain deeply entrenched below the %M/A line.

Sure, it’s entirely possible that after 7 down days, a dead cat bounce may give the bulls some hope, but right now it appears that such a move may be ephemeral in nature.

Again, playing it safe, by being predominantly on the sidelines is the most prudent cause of action, since Europe’s issue are likely not to be solved overnight.

Disclosure: Holdings in TLT

Contact Ulli