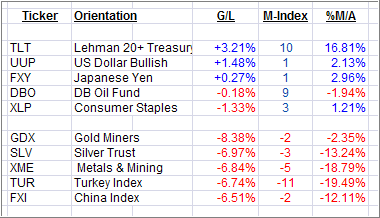

Here is a quick ETF review of the past week’s Leaders and Laggards from my High Volume ETF Master list:

With Europe pulling down world markets, there weren’t too many places to hide. The S&P 500 lost -3.8% and even the hedge against uncertainty, Gold, dropped -3.62% during the last five trading days.

As you can see from the above Leaders list, only the three top ETFs managed to close up for the week, the rest of the bunch in both columns, were all showing red numbers in the Gain/Loss department.

Treasuries (TLT) were up as a result of flight to safety along with the US dollar (UUP) and the Japanese Yen. On the negative side of the equation were the gold miners and metals along with country ETFs Turkey and China.

Please note that most of the Laggards are deeply stuck in bear market territory as the %M/A column clearly demonstrates. It shows the percentage an ETF is positioned above or below its respective trend line.

From my mat, the situation in the Eurozone has worsened and anything can happen at any time with a Black Swan event not being out of the question. If you have any inclinations of seeking more market exposure, this is the time to heed these words of wisdom: “If in doubt, stay out!”

Disclosure: Holdings in TLT

Contact Ulli