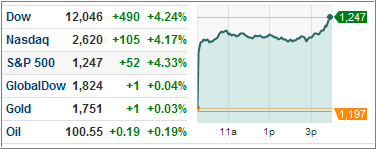

In an investment atmosphere seemingly devoid of any rational order, major indexes moved mountains today as the S&P 500 jumped 4.33% while European indices posted big gains as well. The dollar also depreciated slightly against the Euro to $1.34/Euro.

Notably, the VIX tanked to fall to 27.63. Also, the 10-year Treasury bumped up to a yield of 2.07%. However, we are by no means in risk off mode where we want to start adding on equity ETF exposure at an accelerated rate.

Today’s exuberance appears to largely be driven by a coordinated effort among major central banks – US, England, and Japan among others – to provide much needed short-term liquidity to European banks.

To do this, central banks lowered interest rates on dollar denominated loans so that the ECB could then more easily borrow and then channel those funds to major European banks, who heavily engage in dollar transactions that have become increasingly expensive amidst the current turmoil. There’s no denying that we’re in a danger zone with the extent of these emergency actions.

While this team effort so to speak has possibly staved off a disastrous European credit crunch in the short-term, it doesn’t ensure long-term stability in credit markets. Borderline insolvent countries such as Italy and Spain are still at great risk of collapse. Although major governments were initially hesitant to intervene during the G20 talks, the mood has quickly changed as Europe can’t single-handedly eradicate its own contagion.

A further indication of how severe the European situation is, EU economic and monetary affairs commissioner, Olli Rehn, imposed a 10-day deadline for leaders to decide whether to keep the EU intact or to start dissolving. As MIT economist Simon Johnson has suggested, a Eurozone break-up is likely imminent.

In addition to Europe’s problems, China has had to deal with its own issues. With a slowdown in manufacturing in tandem with lower exports, as well as troubling signs in the housing sector, China reduced its bank reserve requirements to get credit flowing in the system.

Looking at the U.S. economy, today’s Beige Book release from the Fed indicated slow to moderate growth across most of the nation. Despite some improvements in manufacturing output and consumer spending, weak housing and persistent unemployment continue to be a drag on the economy.

We may have seen a couple massive swings to the upside in markets so far this week, but it doesn’t detract from the overall dour picture not only in Europe, but globally. I fail to find much of anything that resonates positively in the markets, although our Domestic Trend Tracking Index (TTI) has now climbed from a negative -0.42% a few days ago to a +2.74% today.

If you were invested in equities, today was a day to be thankful for the Fed lighting a fuse under the markets. If you were predominantly on the sidelines, be very careful in looking for new exposure and do some nibbling in selected ETFs rather than going all in. That will be my plan of action should these levels hold.

To be clear, today’s intervention simply confirmed how bad things are in Europe and that Italy had almost reached the point of insolvency. To my way of thinking, this concerted effort was nothing more than pulling the emergency brake.

As an aside, a lot of retail investors refuse to be drawn into this volatile environment as they have withdrawn $44 billion from domestic equity funds for 14 straight weeks. Since the beginning of 2010, that number has risen to $214 billion.

Contact Ulli