The ETF/No Load Fund Tracker—Monthly Review—October 31, 2011

From Bears To Bulls

October turned into another roller coaster month, as it it appeared that anything was possible. After a string of five losing months, the S&P 500 managed a sharp rebound but, looking at the big picture, this benchmark index remains still down for the year.

October turned into another roller coaster month, as it it appeared that anything was possible. After a string of five losing months, the S&P 500 managed a sharp rebound but, looking at the big picture, this benchmark index remains still down for the year.

This gain did not come without pain as the bears had their way by continuing September’s downward momentum, at least for a few days, during which the S&P 500 dropped below its psychologically important 1,100 level.

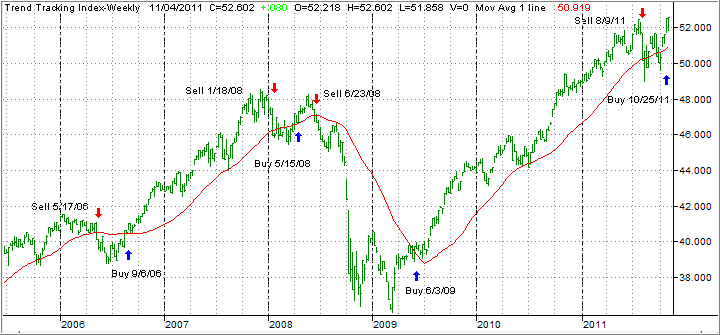

Our Domestic Trend Tracking Index (TTI) followed suit, which supported our position to be out of the market (since 8/10/11). However, downside momentum disappeared as news reports from Europe regarding their newly designed master plan to bail out nations and banks, gave the bulls some hope and a slow rebound ensued.

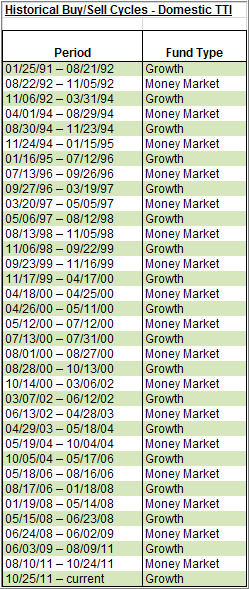

As I posted throughout the month, we essentially went from the low end of the 2 month trading range back to the upper end, hovered there for a few days, and ended up breaking through it. As we slowly ratcheted higher, our Domestic TTI improved as well and generated a new ‘Buy’ signal for domestic equities effective as of 10/25/11, as the table above and the chart below show.

To be clear, the entire market rebound during October was based on nothing but hope and hype that the European summit would result in a solution that would solve all debt issues. While a plan was announced, many details are still lacking as to how exactly it will be funded and if leverage can actually be used.

Given that backdrop, I carefully eased into some equity ETFs as our Buy signal materialized. A 20% exposure to the Total Stock Market Index (VTI) along with a previous 5% allocation to Consumer Staples (XLP) represent our total equity allocation for most clients, along with 20% in the Total Bond ETF (BND) to balance out any sudden market drops. In other words, we’re engaging in a defensive approach and selected offense.

Europe remains front and center in terms of news attraction and, depending on the outcome of the Greek saga, followed by other country candidates on deck, can derail the current rally at anytime. Domestic economic data, while not terrible, still point to an economy that is stuck and going nowhere causing the Fed to utter words like “frustratingly slow.”

On a global basis, things are not improving either, and the main reason for the financial market to display a rally mode is the Fed’s intervention by keeping interest rates low.

Nevertheless, should upward momentum be sustained, I may carefully add to existing positions to stay in tune with current market direction. Our domestic TTI has crossed its trend line to the upside by +3.47% and remains in bullish territory as the chart shows:

[Click on chart to enlarge]However, with this type of news driven market, a directional change can occur suddenly and without warning. That’s why our trailing sell stops will serve as a guide to give us the signal when it’s time to exit either bond or equity positions.

Contact Ulli

Comments 2

Why not include TIF,seems to be doing well ?

Govind,

I don’t deal in stocks, only ETFs and no load funds. If you look at a chart, TIF has been on a roller coaster ride since July by dipping into bear market territory twice, which was accompanied by huge price swings.

Ulli…