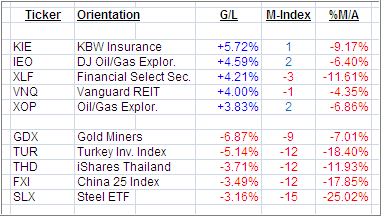

Here is a quick ETF review of the past week’s winners and losers from my High Volume ETF Master list:

Last week’s leader, XOP, remained on the positive side in regards to gains, while all others fell by the wayside. As I commented yesterday, China appears to be slowing down, as its widely followed FXI Index dropped -3.49% in the face of overall growing stock markets.

Looking at the Leaders and Laggards, it becomes glaringly obvious that all 10 ETFs are still vacillating in bear market territory, as you can see by the negative data in the %M/A column, which shows how far above or below its respective trend line (39 week simple M/A) they are located.

This means that most of the rally of the past couple of weeks has pulled the majority of the ETFs out of the basement but not yet into bullish territory. My latest High Volume ETF Cutline report supports my view that many have not yet established their own major trend. Once they do, you will want to participate.

The time may come, as early as next week that I will seek careful equity exposure again, as discussed yesterday. If I do, I will be keenly aware that the European summit, of which the markets expect a positive outcome, can take the starch out of any upward momentum quickly, which can send the bulls packing in a hurry.

Disclosure: No holdings

Contact Ulli