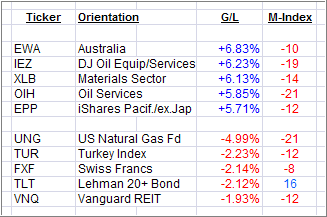

Here is a quick ETF review of the past week’s winners and losers from my High Volume ETF Master list:

After Monday’s drubbing, equity ETFs reversed their downtrend trend abruptly and powered higher supported by economic news that were interpreted as “not as bad” as they could have been. That soothed traders’ nerves and produced a nice rebound from a much oversold condition.

Despite the euphoria, our Trend Tracking Indexes (TTIs) remain in bear market territory, as posted yesterday, supporting our current stance to be either in cash or in some selected bond ETFs.

The market continues to be news driven and direction can change on a dime. Case in point is last week’s Laggard, IEZ, which turned into this week’s (second) Leader.

When equities rally, bonds retreat; as a result TLT lost -2.12% for the week. However, TLT is also the only ETF on this list with a positive M-Index. That means, the long term trend is still on, but short-term, we saw a correction.

When no clear trend direction can be identified, it’s best to stay out and not worry about the ups and downs within any given trading range. You want to participate in equities when major trends develop and not get involved in minor ones, especially when they happen to occur below the line in bear market territory.

Disclosure: Holdings in TLT

Contact Ulli