European debt worries and bank problems certainly have not gone away; they were merely put on hold today with no negatives hitting the newswires.

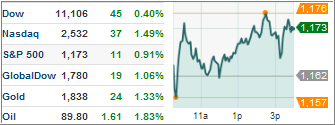

As a result, the domestic markets seesawed but managed to close higher for the second day in a row. However, the health of a variety of European banks is still of great concern and may come back to haunt the markets. Current consensus is if there is a crisis with a European bank, it “will affect but not threaten some of the biggest U.S. banks.”

Domestically, the same old issues with jobs, weak real estate markets and not much consumer confidence were a concern but did not affect the major indexes.

Our Domestic Trend Tracking Index (TTI) inched a little higher and sits now +1.19% above its long-term trend line, while the international index is still deeply stuck in bear market territory and -12.05% below its trend line.

Seems like the markets got a little breather over the past 2 trading days, but this not the time to become complacent as today’s world is a rapidly changing place where bulls and bears constantly battle for trend supremacy. Right now, we’re still stuck in no man’s land.

Contact Ulli