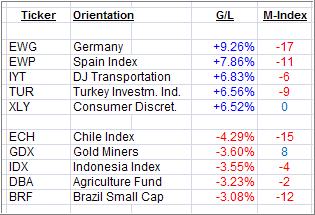

Here is a quick ETF review of the past week’s winners and losers from my High Volume ETF Master list:

From one week to the next, it can be feast or famine. That was the case with last week’s laggards, Germany and Spain, which took top billing this week, as Europe’s debt issues got swept under the carpet, while global markets shifted into rally mode.

Having the same ETFs going from laggards to leaders is clearly a sign of lack of major trend direction. While these types of reversals can make for a great trading environment, they are not conducive for the long-term investor, as you can get stopped out suddenly only to find yourself chasing another rebound.

No matter where you look, M-Indexes for most ETFs continue to be weak, which means clear upward momentum has not been established yet. It’s strictly a news driven market, especially from the European side of the Atlantic, where the odds of a black swan event are increasing daily; at least from my point of view.

It’s better to stand aside than try to participate in what I consider short-term moves that could reverse at a moment’s notice.

Contact Ulli