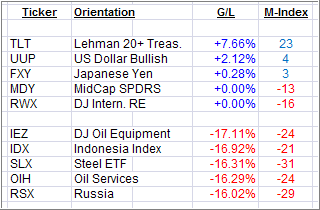

Here is a quick ETF review of the past week’s winners and losers from my High Volume ETF Master list:

With global markets in sharp sell-off mode all week, it’s no surprise to see a flight to safety, especially into U.S. Treasuries and the good old U.S. dollar. When all else fails, and uncertainty races to new highs, the long for dead declared dollar does not seem so bad after all.

It’s been my long-term belief that no matter how bad things are in the world, they will always be better here in the U.S., although it may take a global crisis for this realization to sink in.

Disappointing to me this past week was the fact that gold was not on the list of assets to acquire as the sell-off accelerated, which did not help our core holding in PRPFX. However, that sentiment could change along with a worsening European crisis.

From my vantage point, there aren’t any equity ETFs worth investing at this moment, as the M-Index numbers simply look horrific. Even this week’s Leaders consist of only 3 ETFs that actually gained out of a total of some 90.

That’s telling of the circumstances we are in and, while a bounce off this low point is certainly a possibility, I would not use it to make any long-term commitments. It may turn into another dead cat bounce.

Contact Ulli

Comments 2

I think the reason gold went down, this week, is because a lot of the people holding gold needed to raise cash to cover their losses in equities. So, they sold their holdings, in gold, to raise that cash.

J,

Yes, that has been my understanding too; the question is will there be more of it?

Ulli…