Gold slipped while the S&P 500 gained +2.47% since last Wednesday’s report. As a result, some of our ETF Model Portfolios retreated as well, as the roller coaster ride in the markets continued.

Currently, it’s all about interpretation of the latest news about Greece & Co., while domestic weak economic reports have been mainly shrugged off. Uncertainty continues, and Wall Street traders will eagerly await the outcome of the Fed meeting later on today.

This is the time to just sit and wait until we can better evaluate the major trend. All eyes are on Fed chief Bernanke and, to my way of thinking, nothing less than a grand, unexpected assist will move the major indexes higher. Anything less than that will likely be met with disappointment resulting in a sell-off.

Take a look at this week’s model portfolios:

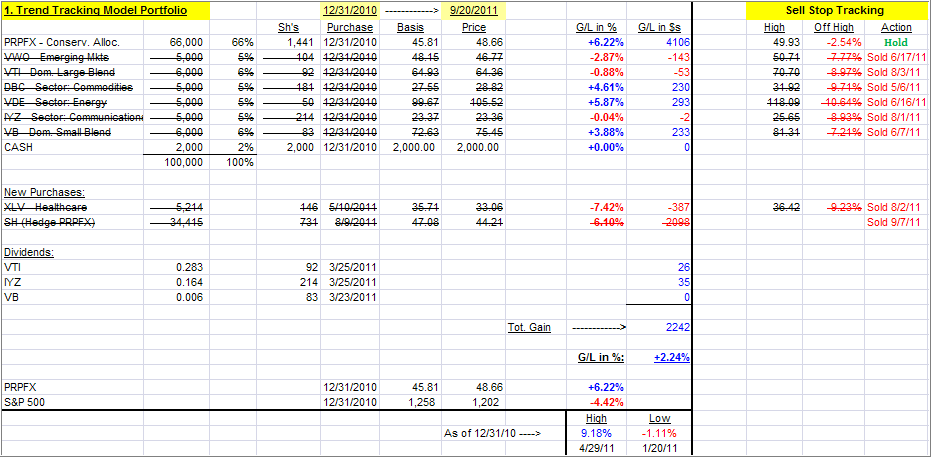

1. ETF Trend Tracking Model Portfolio

[click on tables to enlarge]This is the portfolio allocation I predominantly use in my advisor practice. Given current market conditions, and an ever growing number of global hotspots, I like the concept of having a solid core holding in PRPFX, although with the recent slide, it slipped as well but managed to remain far more stable than the S&P 500 index.

Around this fund, I have added what I call boost components consisting of ETFs that can produce higher returns than my core holding, at least during bullish periods. When a market pullback occurs, the core holding should add an element of stability.

Nevertheless, as you know from my writings, anything I invest in involves the use of trailing sell stops, which are shown and tracked on the upper right of the table.

Last week, this portfolio was up YTD +2.57% vs. +2.24% as of today.

Since the markets did not follow through to the downside on 8/9/11, adding the short position and creating a hedge reduced our unrealized gains by some 2%. This is the cost you pay at times for downside protection.

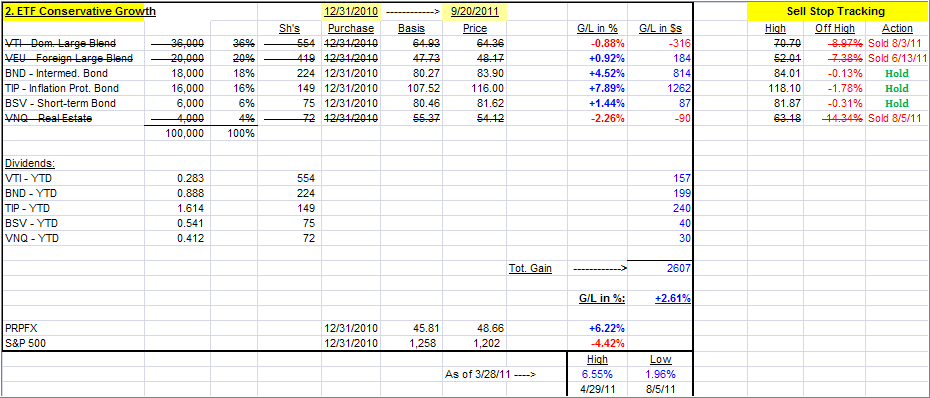

2. Conservative ETF Growth Portfolio

This portfolio, as are the following ones, would be typical of what is being used in the buy-and-hold community, as you can see by the 40% allocation to various bond ETFs. If you are conservative, this simple combination could work for you, but I still recommend the use of the trailing sell stops during these uncertain times.

Last week, this portfolio was up YTD +2.45% vs. +2.61% as of today.

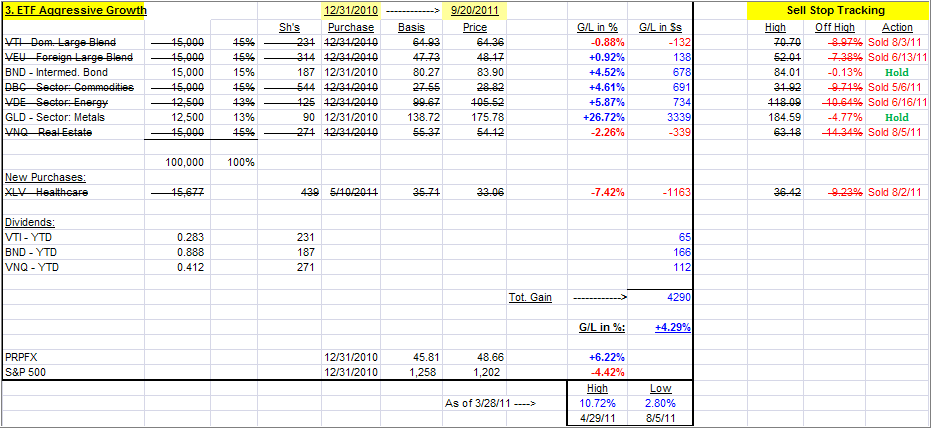

3. Aggressive ETF Growth Portfolio

What makes this one aggressive is the small 15% allocation to bonds. If you have an aggressive streak in your personality, you could consider this one. If you use my recommended sell stop discipline, you know exactly ahead of time what your downside risk will be.

Last week, this portfolio was up YTD +4.47% vs. +4.29% as of today.

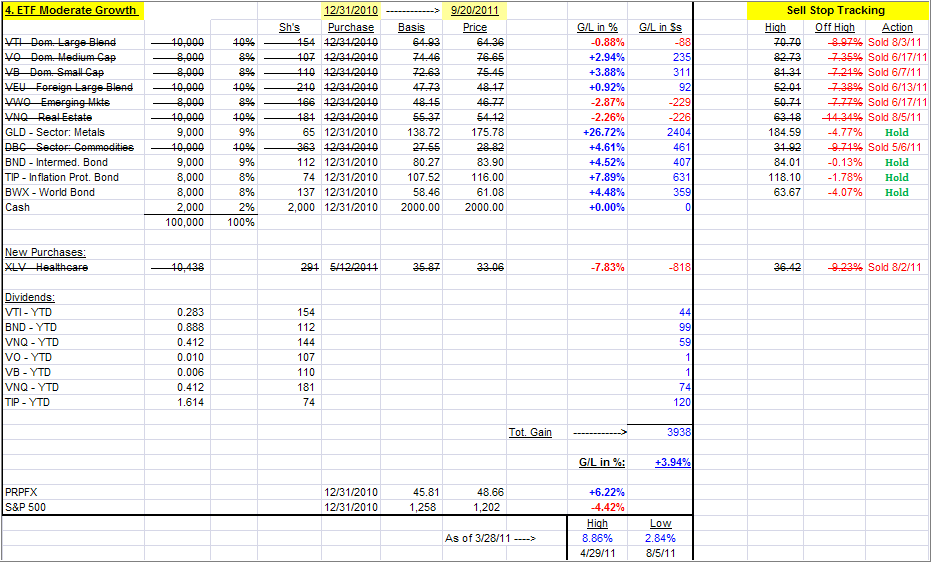

4. Moderate ETF Growth Portfolio

I call this one moderate growth, because of the higher allocation to various bond ETFs (26%) than in the aggressive set up above. It is also more diversfied domestically.

Last week, this portfolio was up YTD +4.40% vs. +3.94% as of today.

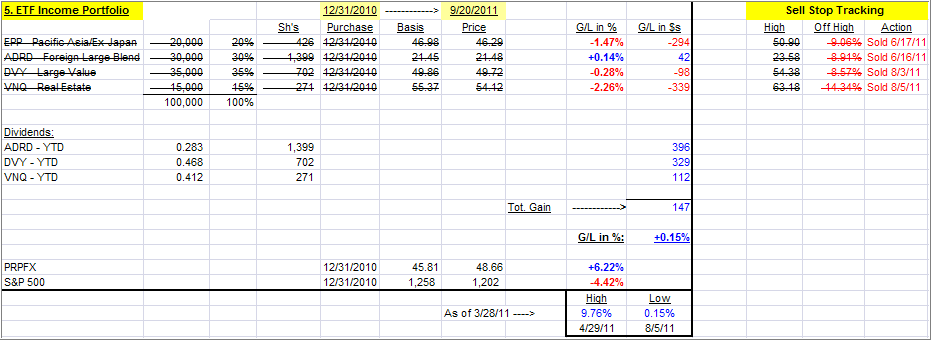

5. ETF Income Portfolio

This is as simple as it gets, but due to a reduction of half of its holdings, this portfolio has slipped into the #5 spot. During the recent sell-off, it dropped in value quickly due to no offsetting bond positions and now shows only a 0% invested balance. Be sure to use a 7% sell stop on the remainder of these holdings.

Last week, this portfolio was up YTD +0.15% vs. +0.15% as of today, and we are in a 100% cash position.

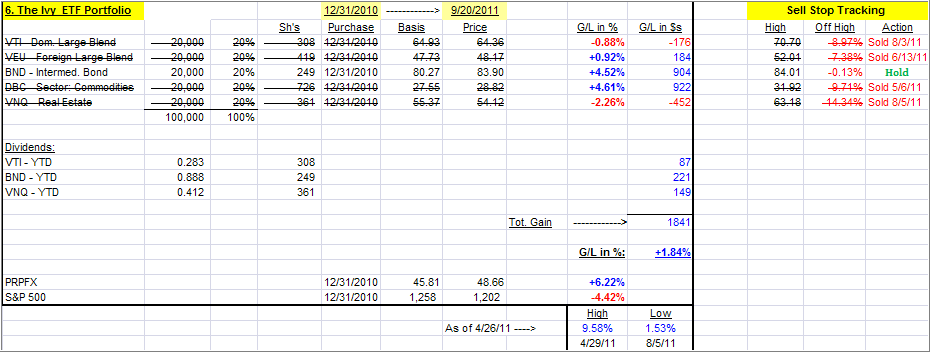

6. The Ivy ETF Portfolio

If you missed the recent post about the Ivy portfolio, you can read it here.

This is a simple 5-asset class portfolio with each individual component being bought when it crosses its respective trendline to the upside. Each component is being sold once it crosses its trend lines to the downside again, according to the author’s rules.

I have made 3 adjustments:

1. I apply a 39-week Simple Moving Average (SMA) to generate the Buys, while the authors use a 45-week SMA.

2. As mentioned in the blog post, I prefer using my trailing sell stop discipline for my exit strategy.

3. Personally. I favor using BND (as opposed to IEF) as my bond component, since it has shown more stabilty in the past.

Last week, the Ivy portfolio was up YTD +1.75% vs. +1.84% as of today.

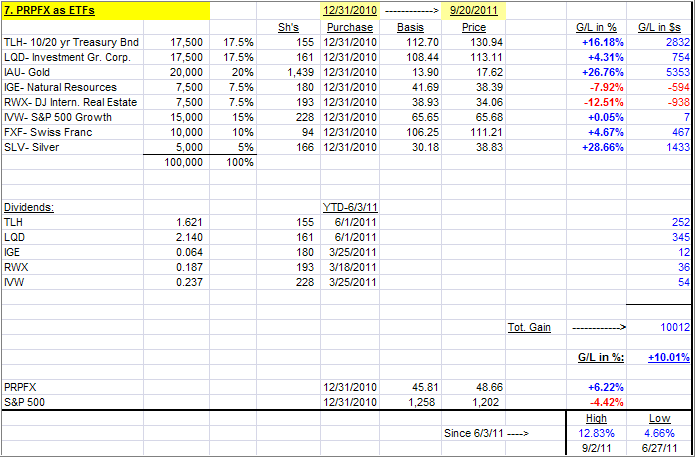

7. The ETF Equivalent of PRPFX

As posted recently, I have created and backtested the ETF equivalent, which clients of mine own as well, of my favorite mutual fund, PRPFX, which is a core holding in my #1 Portfolio. If you missed it, you can read the announcement here.

Take a look at the combination of ETFs:

In the current market environment, where just about all equity indexes have lost, this portfolio has bucked the trend and produced a remarkable result. While this is only one moment in time, and there are no guarantees that this will continue, we need to work here too with a trailing sell stop discipline to guard against excessive downside risk.

Since these 8 ETFs represent only one fund, namely PRPFX, we need to apply a different exit stratgey. For that purpose, I will not track the high points made for each ETF, as with the other 6 models, but measure my drop from the high point this entire portfolio has made. Currently, it is up by +10.01% YTD.

(ETF trading costs are not included in these portfolios demonstrations.)

To repeat, the key to selecting a portfolio from the above list is not just performance. Personally, I’d rather lag a little on the upside but have some assurance that I will also lag when the downside comes into play.

This will help you to sidestep whipsaw signals on occasion, which are caused by temporary market pullbacks followed by a subsequent resumption of the previous up trend.

I will update these portfolios every Wednesday and inform you via email that the updated versions have been posted.

Quick Reference:

Contact Ulli

Comments 2

Uli, I really like the approach you have taken with PRPFX.

quick question:

how do you keep track when PRPFX decides to change its mix of ETF’s– is there a time lag ( 3 months?)

Kareti,

I don’t have any control over that, so I only monitor price action of PRPFX. As far as my ETF equivalent is concerned, I have no plans to change its composition, but will announce it if I do.

Ulli…