With the wild market behavior of the past few weeks, it’s no surprise that many readers having written in with a variety of questions. Today, I want to address two of them, which were most often asked:

With the wild market behavior of the past few weeks, it’s no surprise that many readers having written in with a variety of questions. Today, I want to address two of them, which were most often asked:

I am newly implementing your stop loss strategy. I regrettably have missed the 7% mark and have let my losses become larger due to the recent market volatility, and my own unwatchfulness. I have exited some of my positions.

I was wondering what you would recommend now for the rest of my holdings. Should I sell at a larger loss, and protect any remaining profits, or should I wait for a bounce in the markets before exiting? Or, should I wait at this point for an all out domestic sell order? I am sure that from here on out I will keep closer stop losses! Thanks so much for your guidance.

If you did not execute your sell stops and are worried about more downside risk, I will recommend a course of action I recommended when we discussed the exact same issues during/after the 2008 market crash.

Keep in mind that there is no perfect answer for this scenario. My suggestion is to sell 50% of your current equity positions (the most volatile ones first) and put a sell stop under the balance.

That will fulfill 2 purposes. For one, you will protect 50% of your portfolio by moving to the sidelines, and you have a plan how to deal with the remaining invested 50%. If the markets tank, your risk is only 5% on the remaining balance; if the trend turns around, and the markets stage a rebound rally, you will participate with the 50% you still own.

This will give you a plan of action that is easy to implement, while giving you some means of control in a crazy market environment.

Here’s another question regarding the PRPFX hedge:

I am following your PRPFX hedging strategy and was curious as to when it needs to be rebalanced?

There is no hurry, but if we still own in by the end of this year, you will need to rebalance late in December. The reason for that particular point in time is the distributions.

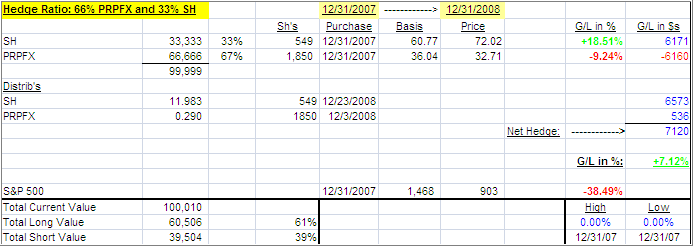

While PRPFX’s is more modest, SH’s can be huge. Take a look again at the 2008 back test and notice that SH distributed $6,573 in this example:

Based on the price at the time, that represented 13.82%, which is huge and will affect the ratio of your hedge. Again, once both distributions have been made, it’s time to rebalance to the desired percentages.

Contact Ulli

Comments 4

Is there a place where you initially explained how you would display the data in the model portfolios. I want to start a PRPFX hedge but generally don’t like to do something I don’t understand. I thought I understood short positions but I am confused as to difference between the basis figure verses the price. I thought “price” was the most recent price but why would SH and PFPFX holdings be different in terms of price? Is there a 101 on this in your archives?

Kathy,

If you don’t understand something, especially when it comes to investing, you should not do it. I talked about the hedge here:

https://theetfbully.com/2011/08/thoughts-on-hedging-the-permanent-portfolio-fund-prpfx/

If this is confusing to you, and judging by your question it appears that it is, do not get involved. Stay in cash on the sidelines and wait for opportunities when this bearish slide ends.

Ulli…

Regarding your PRPFX Hedge strategy: I was looking up the distributions for SH and see the last time paid was Dec, 2008. You indicate that at on that date your strategy received $6573 in distributions. However, no distributions were paid in 2009 or 2010? Can we be assured that there will be distributions in 2011 or 2012? Please explain. Thanks for all your insight!

Vicky,

I don’t know if there will be distributions, and it does not matter. My point is when they do occur, re-balancing is necessary to keep the hedge in its recommended ratio.

Ulli…