It was another wild day on Wall Street, as the Dow dropped from a gain of 150 points to a loss of more than 200 points, followed by a recovery of 430 points.

The main event of the day was the announcement by the Federal Reserve that QE-3 is not on the table (disappointment), but that interest rates may remain at records lows for some 2 years (euphoria).

Aiding the volatility was the fact that the markets had been extremely oversold, some profit taking was going on and, after a rebound off the bottom, heavy short covering set in to power the major market ETFs out of the abyss.

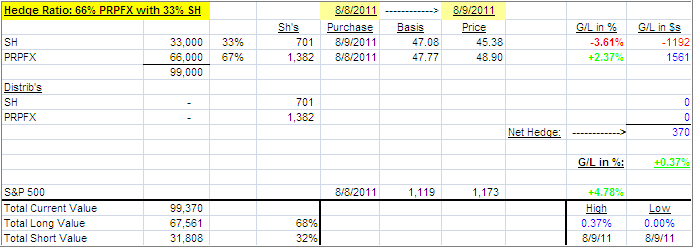

Things looked dicey for a while and, as announced yesterday, I added the SH component to set up our hedge for PRPFX. There is no clear cut entry point, especially when the market moves with lightening speed, but I indicated via the red arrow in the chart above when the hedge was finalized.

Obviously, with the benefit of hindsight today would have been a good day to be outright long, but you can never be sure beforehand.

This is where our hedge stands after today’s close:

[Click on table to enlarge]With today’s rebound, our Trend Tracking Indexes (TTIs) recovered and are showing the following position relative to their long-term trend lines:

Domestic TTI: +0.08%

International TTI: -9.78%

As you can see, the Domestic TTI just barely slipped back above its long term trend line. Seems like déjà vu, as we’ve done the trend line dance with the international TTI back in June, until it finally succumbed to bearish forces.

I will not issue a new domestic Buy signal until the trend line has clearly crossed to the upside again and has held that position for a few trading days. Using this cautious approach helped us avoid a whipsaw signal in the international arena.

While today’s bounce off the bottom was somewhat overdue, one day’s activity does not make a trend. We will hold on to our hedged positions for the time being and remove the short component of the hedge should the bulls get the upper hand again.

The issues, that affected this market to the downside in recent weeks have not been resolved and could worsen at anytime. It pays to be cautious in this environment, where outright longs and shorts can easily get slaughtered, but a more neutral position appears to be a better way to deal with this market uncertainty.

Contact Ulli

Comments 2

Tuesday’s action was a head fake of the highest order. We trend down

Sure looks that way now, John….

Ulli…