No negatives with any impact on the markets could be found today, as the major market ETFs shifted into recovery mode in part by driven by relief that Hurricane Irene’s damage appeared to be less than expected while, at the same time, consumer spending was stronger than expected.

Adding to that bullish menu was renewed hope that the Fed may after all produce some kind of rescue program this fall. Who knows, I did not read anything about it, so maybe it’s nothing but a rumor started to assist the bulls…

News out of Europe was cheerful, as it was announced that 2 of Greece’s largest banks were discussing a merger, which caused local stocks to have their best one-day rally in 20 years. Hmm, I just can’t figure out how merging 2 insolvent banks might resolve the enormous debt issues.

As the rally got under way, it did not fall apart half way through the trading session as we’ve seen so many times during the last month. This caused additional buying along with short covering providing more ammunition to the upside.

The only fly in the ointment was very light volume with many traders and money managers still being out of town this week. I would expect more exaggerated moves until everyone returns after Labor Day, so don’t read too much into this week’s action.

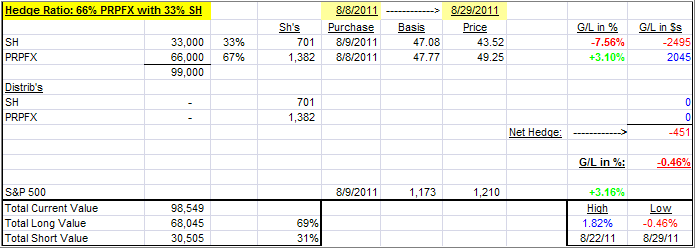

Nevertheless, as markets go higher, we need to pay attention to our hedged position, which closed the day as follows:

During the past 3 weeks that the hedge has been in effect, we reached a high of +1.82% and a low last week of -0.46%, which was touched again today. When markets move higher, this type of hedge will move lower, as we’ve seen, and end up becoming a drag on performance as the table above clearly shows. Had the markets reacted more violently to the downside, as I expected, we would have looked far better than we do now. Yes, the benefit of hindsight…

If there is more upside activity within the next day or so, I will liquidate the short position and become net long with PRPFX. I am not too worried about being long PRPFX, since it has proven itself to hold up better than most during market sell offs.

Same goes for our Domestic Trend Tracking Index (TTI), which has been hugging its trend line from both sides. Now we’re back above the line by +1.75%. I will wait for more confirmation to the upside before issuing a new domestic Buy signal.

Contact Ulli

Comments 1

very helpful, thanks Ulli.