Life after the completion of the endless debt ceiling debate proved to be a challenge for Wall Street, as finally the economic reality sank in that all is not well with the alleged 2nd half recovery.

Life after the completion of the endless debt ceiling debate proved to be a challenge for Wall Street, as finally the economic reality sank in that all is not well with the alleged 2nd half recovery.

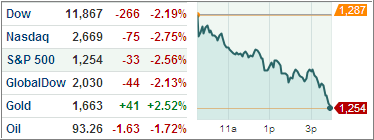

With today’s sharp selloff, serious technical damage was done, as widely watched major trend lines were violated, which could invite more selling. Especially disheartening was the fact that we closed at the lows of the day, as the chart above (courtesy of MarketWatch.com) clearly shows.

Here are some of the widely followed indexes and the percentages by which they have moved below the line and into bear market territory:

S&P 500 200-day M/A: -2.40%

DJIA: -1.51%

DJ Transportation: -4.84%

Our Trend Tracking Indexes (TTIs) are currently situated as follows:

Domestic TTI: +2.17%

International TTI: -4.09%

This morning, I liquidated XLV and IWS, after having sold IYZ yesterday. While these 3 ETFs had not reached their respective trailing sell stop points, they all had broken below their long term trend lines into bear market territory, which is always an overriding factor.

This is the type of market environment I had in mind when I talked about my Trend Tracking Portfolio containing a core holding like PRPFX, since it did exactly what it was supposed to and that is give our portfolios some means of stability when a market shakeout occurs. That is exactly what has happened.

As a result of today’s sell off, PRPFX only gave back a modest 0.34% as opposed to the S&P 500’s 2.56% loss.

On the other hand, the ETF equivalent of PRPFX, which I introduced last Sunday, closed up in the face of adversity by an astounding +0.78% and has made a new high YTD.

This ETF combination will be added as Portfolio #7 and posted tomorrow. Be sure to look for it.

As I have saying for weeks, be sure to track your sell stops and execute them when necessary. If you have done so, you should be feeling pretty good about yourself in that you had a plan, and you executed it without falling prey to euphoric news media reports.

Contact Ulli