Amazingly, today’s rebound was based on nothing but hope that the Fed’s Bernanke will pull another rabbit out of the hat this Friday via the mother of all stimulus proposals, which will solve all that ails the world.

The amount of bad news was small enough to stimulate markets around the globe in anticipation of what the Fed might come up with. My take is that it will be nothing spectacular with the result that hope will turn into disappointment.

In other words, if the Fed chairman doesn’t deliver the goods with the magnitude anticipated, the sell off could be ugly. This is not a forecast but simply my opinion at this point.

So far, it’s been a nasty August with the Dow and S&P 500 potentially facing their worst performance since early 2009, while the Nasdaq’s 11% slide, if it holds, will be its worst since October 2008.

Our Trend Tracking Indexes (TTIs) rallied as well and have reached the following distances from their respective long term trend lines:

Domestic TTI: +0.47%

International TTI: -10.22%

As I have said before, the domestic TTI seems to either hover slightly above or below its trend line, but not enough to call the brief dip into bear market territory to be over. I will maintain my bearish stance until upside momentum has been clearly restored.

The violent moves of the past month are typical of bear market rallies and usually happen at major inflection points, especially once downward momentum accelerates, and we move into bear market territory. The bulls put up quite a fight, but will likely succumb to bearish forces. As a result, the Dow has produced gains and losses in excess of 100 points more than 11 times this month.

Clearly, this is an environment without an identifiable long term trend where both, outright longs and shorts, can get slaughtered in a hurry. It’s wise to either stand aside or remain in a hedged position.

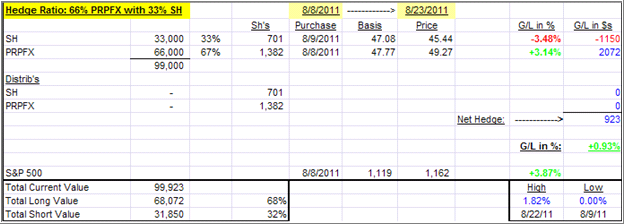

Our current PRPFX hedge has performed as follows:

Right now, I expect volatility to continue until we hear words of wisdom from Fed chief Bernanke on Friday. That will be the moment of truth, and we will find out if today’s rebound was for real or if it was simply a pump-and-dump maneuver.

Contact Ulli