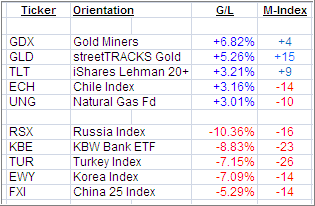

Here is a quick ETF review of the past week’s winners and losers from my High Volume ETF Master list:

Major Market ETFs got spanked again, but to a lesser degree than the prior week. We had a change in some of the leaders and laggards.

As was no surprise, the flight to safety continued making GLD, GDX and TLT the top gainers for the past five trading days. On the downside, some country ETFs got hammered, but ECH resisted, as less risky investments, and those considered a currency equivalent (gold), were drawing funds away from equities.

Domestically, we are still bouncing around the long-term trend line, a condition which is sure to be temporary, until a breakout occurs. The open question is will it be deeper into bear market territory or back into the bullish camp.

Both options are possible but, looking at the overall global landscape, a downside break is more likely at least from the facts as they are available right now. There will always be bounces, the question is whether they have legs or not. My guess is that we eventually will break further into bear territory; if not, I will adjust my positions based on the changes in momentum.

Disclosure: Holdings in GLD, TLT

Contact Ulli

Comments 2

Ulli,

Are you using a 7% or 10% sell stop for your GLD holding?

Same question for VWO if/when you hold it.

Thanks,

Paul

Paul,

Since both of them are sector ETFs, I use 10%.

Ulli…