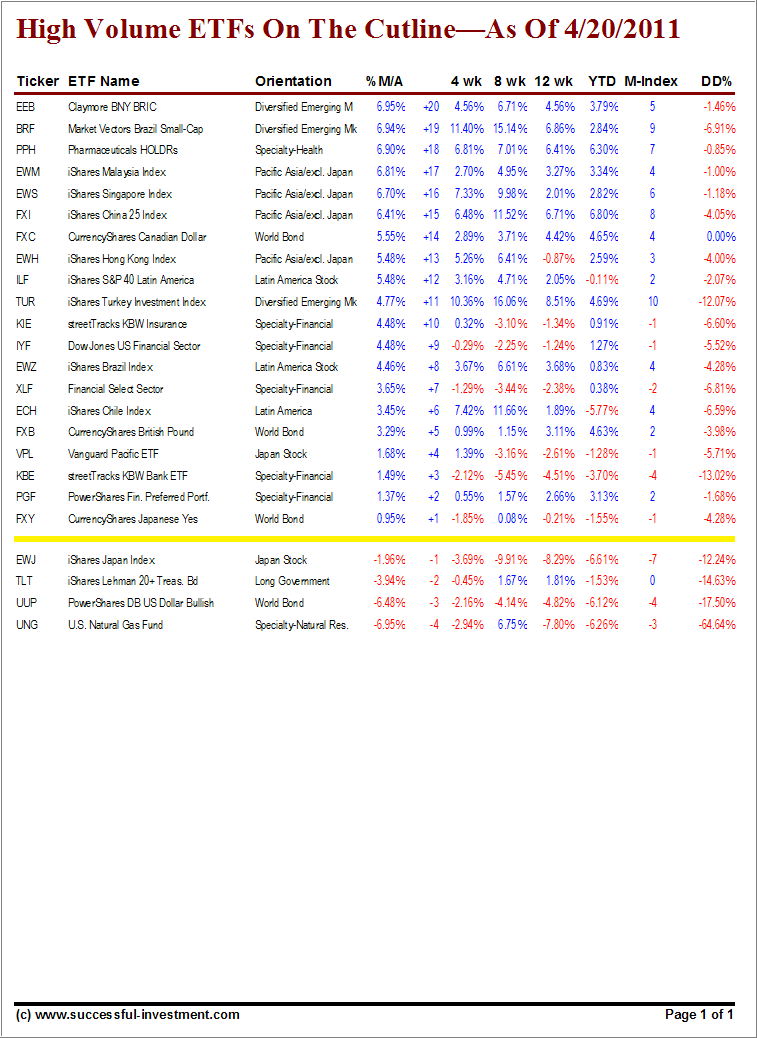

As reported last week, here’s a slightly different version of the original “ETFs On The Cutline” report. It includes only High Volume (HV) ETFs, which I define as those with an average daily volume of $10 million or higher.

These ETFs are generated from my selected list of 90 that I use in my advisor practice. It cuts out the “noise,” which simply means it eliminates those ETFs that I would never buy because of their volume limitations.

Short ETFs are not yet included but will be in the future. Take a look at the table:

For better viewing and printing, download the PDF:

http://www.successful-investment.com/SSTables/HVETFCutline042011.pdf

Again, we’re 2 years into this bull market, so there are not many ETFs below the line, although there has been some repositioning above it. The bottom of the barrel remains the Natural Gas fund (UNG), which has been on a losing streak for years.

If you are a new reader and missed the original Cutline report, which also featured some “how to use” information, please review it here.

Quick Reference:

4/13/11 issue: https://theetfbully.com/2011/04/high-volume-etfs-on-the-cutline%E2%80%94updated-through-4132011/

Contact Ulli