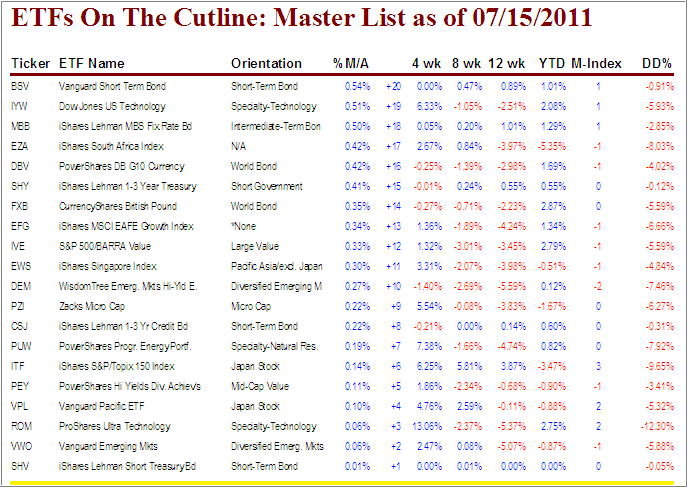

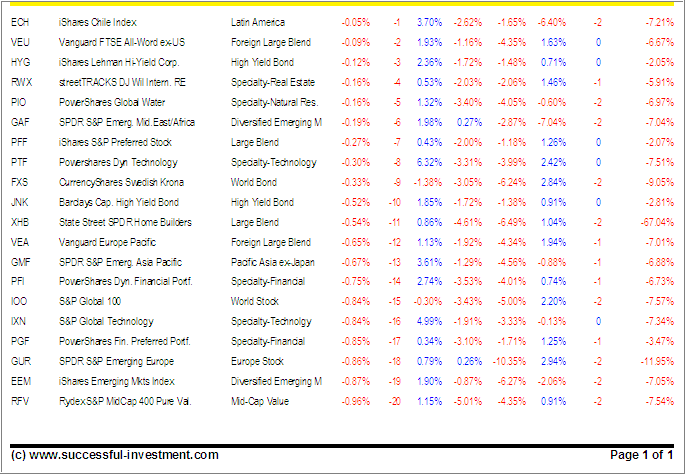

With the S&P 500 having lost 2.1% during last week’s sell-off, most of the activity around the cutline was to the downside. Even High Yield Bonds (JNK) continued their roller coaster ride, as they now again slipped below the line to -10 from the previous +6 position.

Right now, there is simply no stability as far as upside momentum in the equity arena is concerned. The positive action has taken place with Precious Metals, Natural Resources and Health Care. However, volatility is quite high, and there are very few ETFs with low DrawDown numbers (DD% column).

You will be able to see these comparisons much better in the new and expanded Cutline report, which I hope to have completed by next week. Rather than being able to view only the first 20 ETFs above the cutline, you will have the choice to view the first 200 listings, if there are that many.

Take a look at this week’s report:

[Click on tables to enlarge, copy and print]

With the European debt crisis picking up stream, and the domestic debt ceiling issues remaining a hot topic, stay with your existing holdings until you get stopped out. Once you do, try not to be overeager to replace what you have just sold.

In these times of uncertainty, there is nothing wrong with temporarily having a higher cash position, until better opportunities present themselves.

Reference: “How do I use the ETF Cutline Table to make a Buy decision”

Previous posts:

ETF Cutline Post as of 7/8/2011

ETF Cutline Post as of 7/1/2011

ETF Cutline Post as of 6/24/2011

ETF Cutline Post as of 6/17/2011

ETF Cutline Post as of 6/10/2011

ETF Cutline Post as of 6/3/2011

ETF Cutline Post as of 5/27/2011

ETF Cutline Post as of 5/20/2011

ETF Cutline Post as of 5/13/2011

ETF Cutline Post as of 5/6/2011

ETF Cutline Post as of 4/29/2011

ETF Cutline Post as of 4/21/2011

ETF Cutline Post as of 4/15/2011

ETF Cutline Post as of 4/8/2011

ETF Cutline Post as of 4/4/2011

Disclosure: No holdings

Contact Ulli