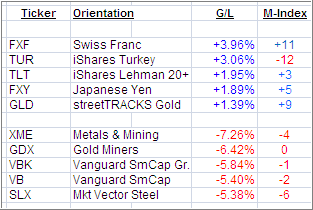

Here is a quick ETF review of the past week’s winners and losers from my High Volume ETF Master list:

As the markets got clobbered last week, the flight to safety was an obvious choice for those who buy and hold and/or have no exit strategy.

Consequently, in the ‘Leader’ section, the Swiss Franc (FXF) ruled, followed by long-term Treasuries (TLT) and Gold (GLD), which has proven to be a good defensive holding against global uncertainty for quite some time.

On the losing side of the equation, gold miners suffered steep losses along with SmallCap equity ETFs

Overall, the domestic equity markets are reaching a critical point. Here are some of the major indexes and their positions relative to their long-term trend lines, which I recalculated after Friday’s close:

S&P 500 50-day moving average: -1.29%

S&P 500 200-day moving average: +0.58%

S&P 500 Death Cross: +1.89%

DJIA 200-day moving average: +0.79%

DJ Transports 200-day moving average: -0.18%

As you can see, some of the major indexes are within striking distance of piercing their respective long-term trend lines to the downside. More bearish action is very likely, if the debt ceiling debate dies on the vine, and the AAA credit rating of the U.S. is affected.

Make sure you know where your sell stops are.

Disclosure: Holdings in GLD

Contact Ulli