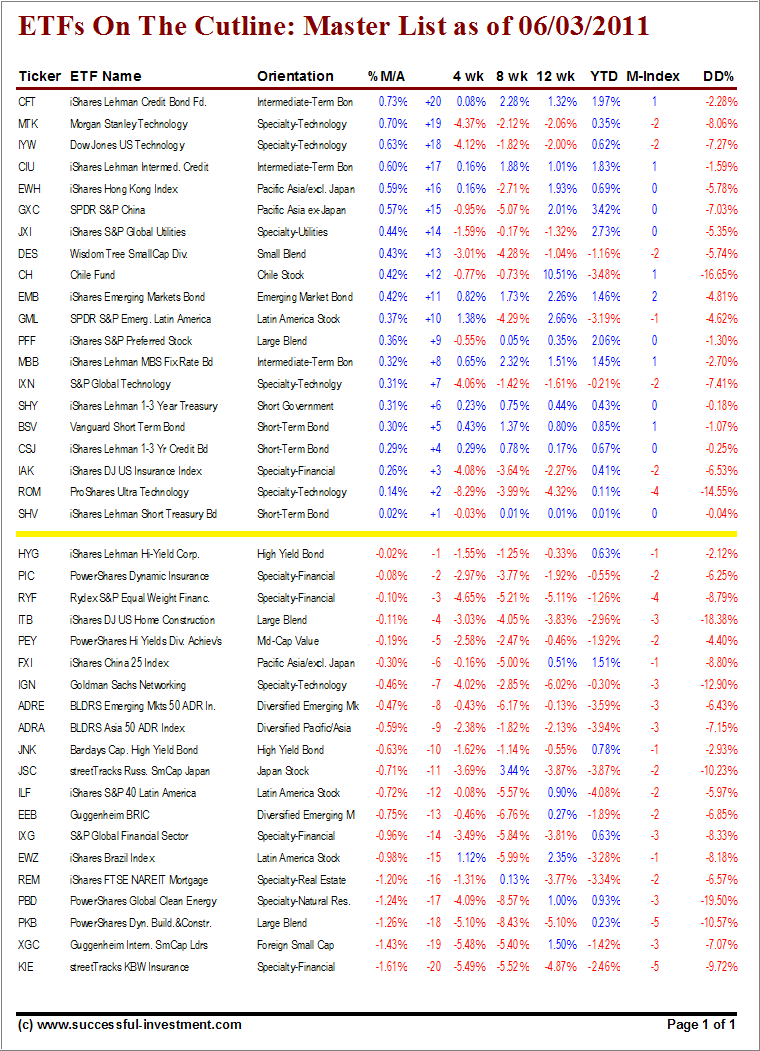

With the market bulls getting the sledgehammer treatment last week, there obviously was more weakness than strength in the most current ETF Cutline report.

As I mentioned before, when domestic markets succumb to bearish forces, at times selected county ETFs buck the trend and move higher, or at least hold their ground. That was the case last week as the Hong Kong index (EWH) rallied from a +11 position above the trend line to +16, while Emerging Latin America (GML) stayed pretty firm by slipping only from +13 to +10.

Dropping in from a level above +20 was the S&P China index (GXC), which settled at +15.

Weakness was apparent with ILF (Latin America), which sank from +7 to -12. A lesser drop happened to EEB (Diversified Emerging Markets), which slipped from -7 to -13.

Again, it’s important for me to point out that, as I posted in “How do I use the ETF Cutline Table to make a Buy decision,” just because an ETF rallies above its trend line, does not mean it’s a buy. If you missed it, take a look at the link for details on what to look for before making a decision.

Here’s this week’s report:

[Click on table to enlarge, copy and print]

Momentums number for all equity ETFs (not bond ETFs) in this report are negative, and DrawDown numbers (DD% column) are worsening. This is not the time to be a hero and engage in bottom fishing. Watch your trailing sell stops and execute them when necessary.

If you are looking to deploy new money in those equity ETFs, which have just crossed their trend-line to the upside, this report shows that there are no new opportunities.

For quick reference:

ETF Cutline Post as of 5/27/2011

ETF Cutline Post as of 5/20/2011

ETF Cutline Post as of 5/13/2011

ETF Cutline Post as of 5/6/2011

ETF Cutline Post as of 4/29/2011

ETF Cutline Post as of 4/21/2011

ETF Cutline Post as of 4/15/2011

ETF Cutline Post as of 4/8/2011

ETF Cutline Post as of 4/4/2011

Disclosure: No holdings in ETFs discussed

Contact Ulli