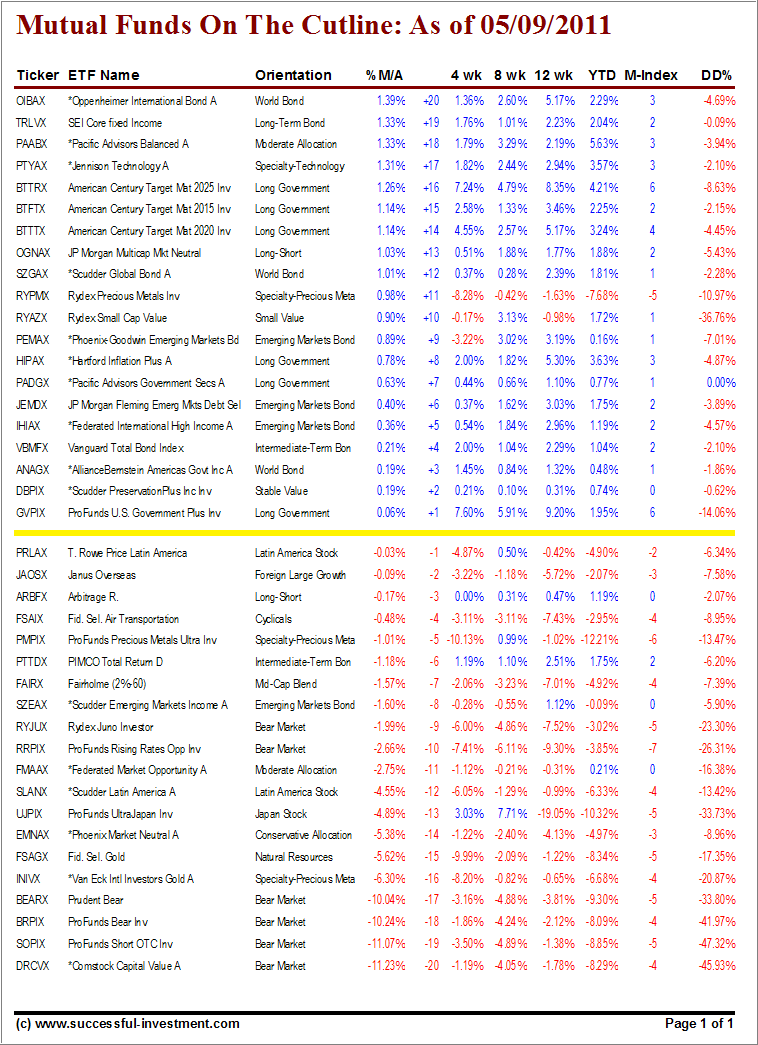

This week, it was déjà vu. With most equity funds hovering way above their respective trend lines, the juggling around the cutline occurred with bond and moderate allocation funds.

Despite fear of higher rates, this cutline report confirms the tendency towards lower ones; at least for the time being.

For example, the most sensitive bond funds are zero-coupon funds; the further out the term, the more volatility they will display as interest rates bounce around under various market conditions.

For example, BTTRX, with a maturity of 2025, is the most volatile one and moved from a -6 position last week to +16 as of yesterday. The well known Vanguard Total Bond Index (VBMFX) managed to break through to the upside to the +4 position.

With the equity markets having sold off last week, FAIRX dropped back below the line to -7 from its previous +5 position leaving only 1 lonely equity fund in the first 20 above the cutline.

That fund is the RYAZX, which declined from +12 to +10. However, its momentum numbers remain on the weak side.

Take a look at the table:

[Click on table to enlarge, copy and print]Just as in this week’s ETF Cutline report, there are no equity funds around the cutline that are a worthwhile addition for new money.

Quick reference to recent issues:

Disclosure: No holdings in funds discussed

Contact Ulli