A rising tide lifts all boats, and that was the case in some sectors. Despite the weak overall equity market conditions, a few funds in the technology and financial sector recovered and headed back above the cutline.

Here are the movers in the financial sector:

ICFSX Financial (ICFSX) from -17 to +1

T. Rowe Price (PRISX) from -5 to +13

In technology, we saw the following position changes:

Fidelity Select (FSCSX) from -20 to +2

Jennison (PTYAX) from +1 to +16

In the Pacific Asia area, ICON funds (ICARX) recovered from -16 to +17.

While these are nice moves above the cutline, it does not mean those funds are in a buy mode due to their predominantly negative momentum numbers and large DrawDown (DD%) figures. You want to see blue numbers all the way across and a low percentage number in the DD% column. From the funds listed above, however, one comes very close.

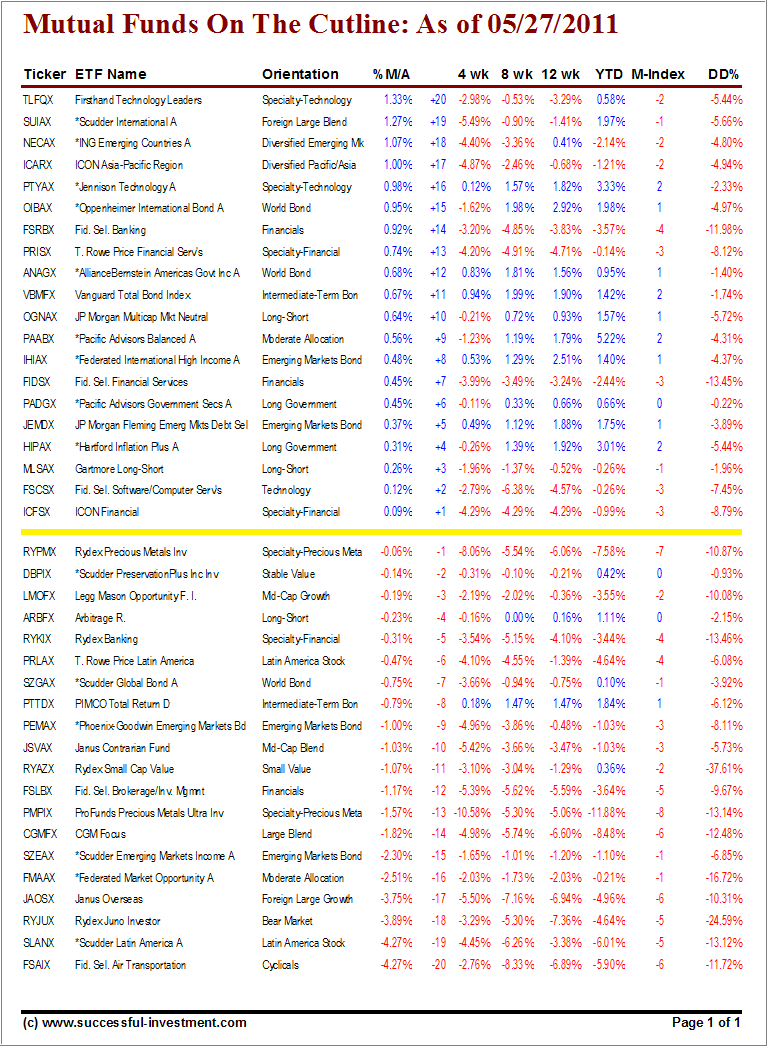

Let’s take a look at the table first:

[Click on table to enlarge, copy and print]You will have noticed that PTYAX has positive momentum numbers across, but the DD% is still a little high. If you have new money to deploy, you may want to watch this fund and make sure it holds or, better yet, improves its position to over 1% above its trend line (%M/A) while lowering its DD% number.

For this sector fund, I recommend a 10% trailing sell stop discipline.

Quick reference to recent issues:

Disclosure: No holdings in funds discussed

Contact Ulli