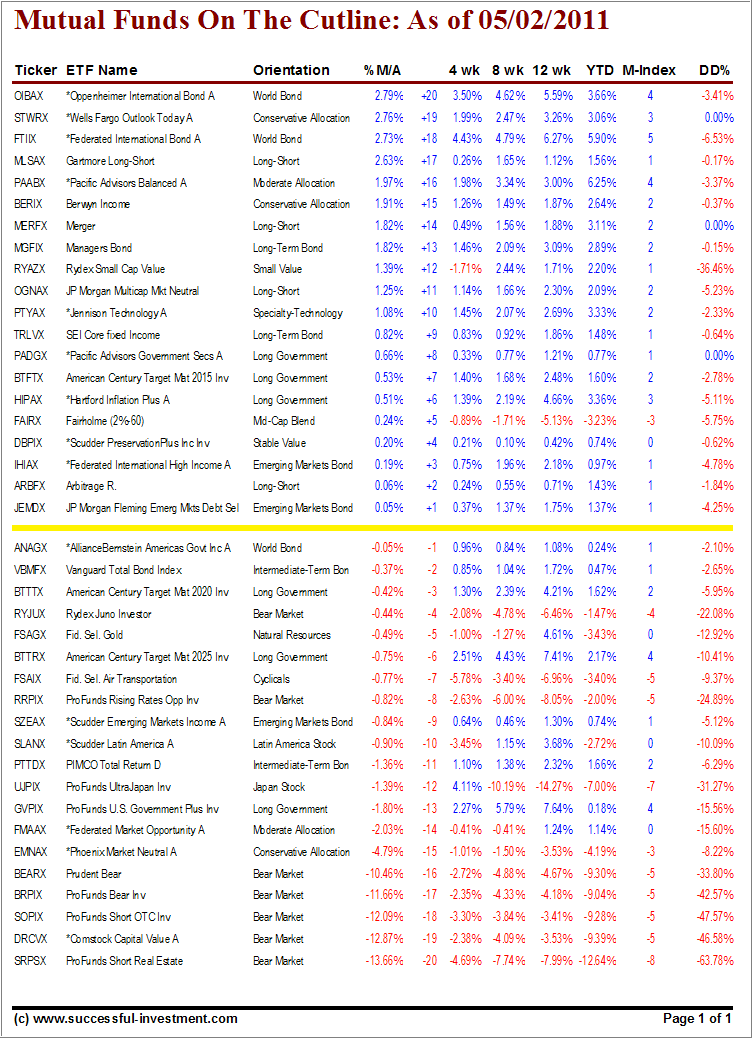

With just about all equity funds being in the stratosphere, and above their respective trend lines, most changes occurred this week with bond and conservative allocation funds.

As per the Fed, a zero interest rate policy is being maintained, and some of the bond funds are confirming this trend by heading higher and, in some cases, having crossed their trend line (cutline) to the upside.

Despite fear of higher rates, this cutline report confirms the tendency towards lower one; at least for the time being:

PADGX is now firmly entrenched above the cutline at a position of +8 from last week’s +5.

A larger move was made by BTFTX, which moved from -4 to +7. The Vanguard Total Bond Index (VBMFX), of which we own the ETF equivalent (BND), has climbed from -8 to a -2 position and has come within striking distance of breaking through to the upside again.

Take a look:

[Click on table to enlarge]

Watching the above table once a week is an excellent way of cutting through the daily market noise by seeing what’s really going on when it comes to current interest rate direction.

Quick reference to recent issues:

Disclosure: No holdings other than BND

Contact Ulli