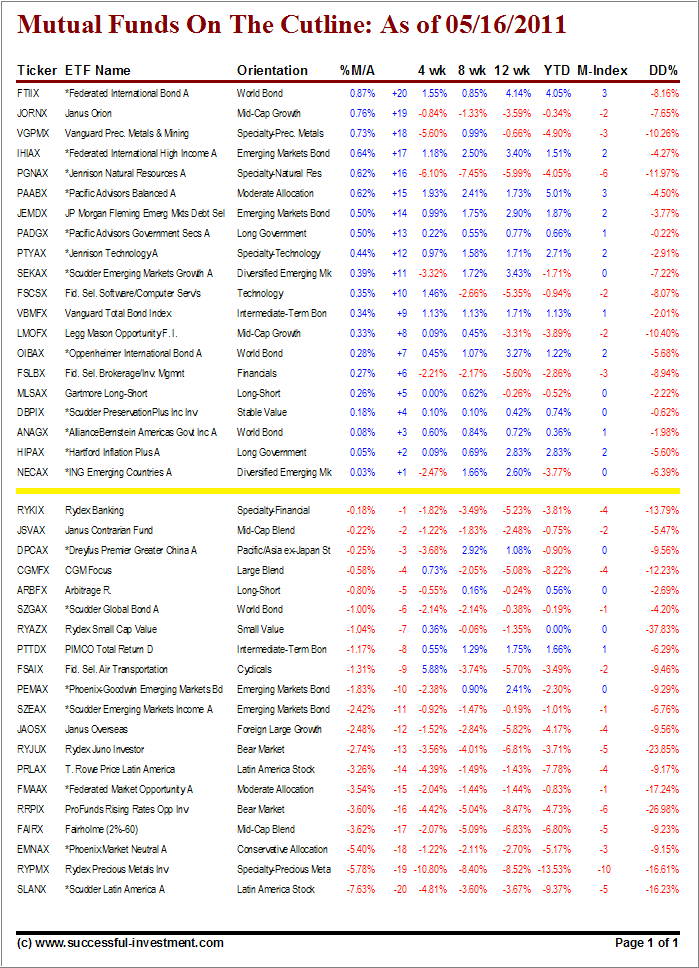

The weakness in the markets, which was apparent in yesterday’s ETF Cutline report, has affected equity mutual funds as well; no surprise there.

The mover this past week in the equity arena was JORNX, which dropped in from a level above +20 to occupy the +19 spot. As you can see, all of its momentum numbers are negative and you already would have been stopped out with the DD% column showing -7.65%.

Here are a few more equity funds which headed south during the previous week:

Rydex Small Cap Value (RYAZX) from +10 to -7

Janus Overseas (JAOSX) from -2 to -12

T. Rowe Price Latin America (PRLAX) from -1 to -14

Fairholme fund (FAIRX) from -7 to -17

Scudder Latin America (SLANX) from -12 to -20

Some of these have already dropped below their recommended sell stops and some are close. Remember, for volatile sector and country funds, I recommend 10% as a sell stop discipline.

While there are only a few equity funds lurking close to the cutline, none of them have positive momentum numbers across, which means they are not an automatic buy should they manage to climb above the yellow line on a sudden rebound.

Let’s take a look at the table:

[Click on table to enlarge, copy and print]

With only a couple of exceptions, all moves to the upside have occurred in the bond arena, which is a normal reaction when equities retreat. Renewed upward momentum is needed to make a case for equities should before investing new money.

Quick reference to recent issues:

Disclosure: No holdings in funds discussed

Contact Ulli