This was the question on reader Daniel’s mind as he emailed the following:

This was the question on reader Daniel’s mind as he emailed the following:

I am retired and looking for a “reliable & safe” dividend paying ETFs for income.

Three ETFs that I have looked at are:

1. SDY – Tracks HY Div Aristocrats Index 2. VIG – tracks Mergect Div Achievers Index 3. DVY – tracks DJ Select Div Index 4. Others?

What is your recommendation?

Let’s first hone in on the word ‘reliable’ on Daniel’s wish list. I assume that he means reliable in terms of providing a regular income stream. If you look at the dividend histories of SDY, VIG and DVY, you can see that they indeed paid their dividends on a regular basis.

The more difficult determination to evaluate is whether any of these ETFs are ‘safe.’ Daniel was very vague, so here again I have to assume that he refers to price stability. The short answer is sometimes prices are stable and sometimes they are not and plunge.

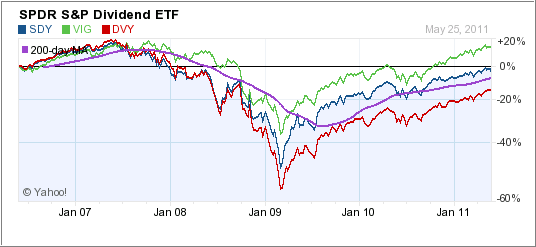

Let’s take a look at a five year chart (courtesy of YahooFinance) of Daniel’s ETF selections:

During the crash of 2008 it has become very clear that, if you held any type of equity investments, no prisoners were taken and just about any asset class plunged in value.

The obvious answer to Daniel’s question about ‘safe’ ETFs is that while during bullish periods, you can observe some price stability within normal fluctuations, but once the bear strikes, all bets are off.

As a result, if you are a retired person looking for income via income ETFs, you still cannot afford to turn this into a buy-and-hold proposition. If you are lucky, you may skate along for a few years with no major corrections, but sooner or later, when you least expect it, the bear will get you. It’s just a matter of time.

To avoid a repeat scenario of 2008, you can be invested in the income producing ETFs on Daniel’s list, but only while the major trend is up as identified via my trend tracking approach. Use my domestic TTI (Trend Tracking Index) as a guide which, when combined with my recommended trailing sell stop discipline, can assist you in avoiding the brunt of the worst market disasters.

During those times when you are out of the market, you simply need to dip into your principal to make ends meet. If you don’t, and stay invested, rest assured Mr. Market will exact a rather large tuition as he teaches you the difference between buy-and-hold and trend tracking.

Disclosure: Holdings in DVY

Contact Ulli

Comments 2

Your reply to Daniel refers to your Trend Tracking Index. The index sounds most useful. Is it on the website? Is here a tutorial for it?

Thanks for running a most informative newsletter.

With best Regards

David,

The Trend Tracking Indexes (TTIs) are the cornerstone of our trend tracking methodology. They are featured every Thursday in the StatSheet, sections 1 and 4. You can read the latest issue here:

https://theetfbully.com/2011/05/weekly-statsheet-for-the-etfno-load-fund-tracker-updated-through-5262011/

If you haven’t, you might want to sign up for my free newsletter, so you won’t miss any information on this subject:

https://theetfbully.com/free-etf-newsletter/

Ulli…