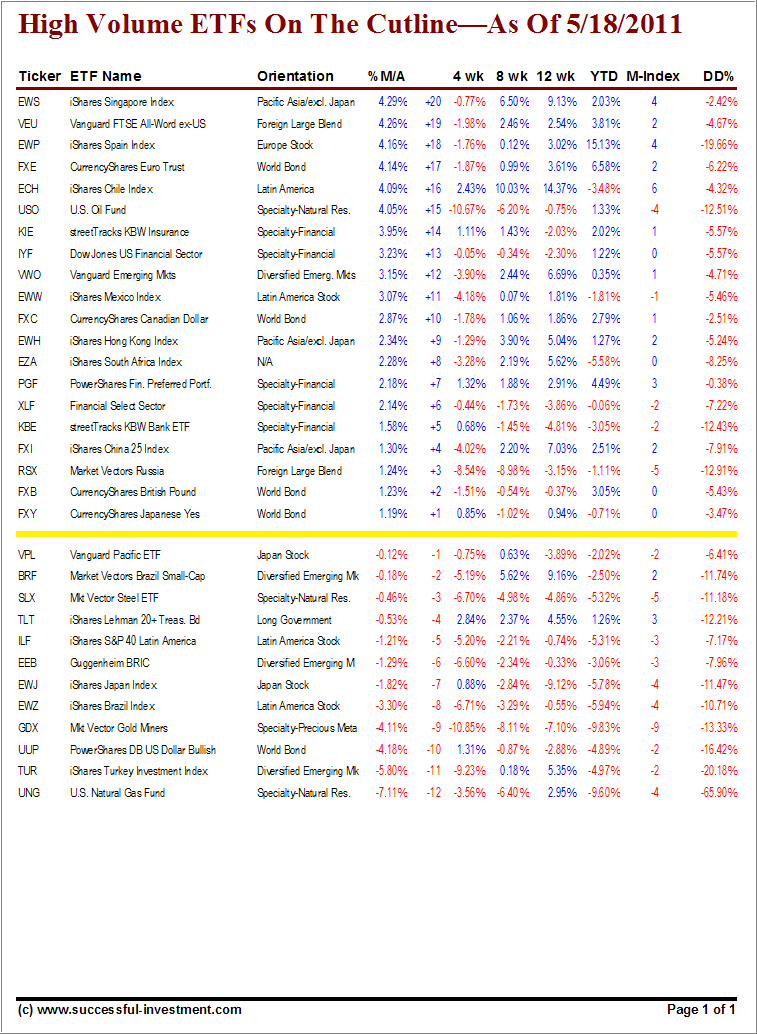

Here’s the latest update of those High Volume ETFs, which are hovering within 20 positions below and above their Cutline (trend line). High Volume (HV) ETFs are defined as those with an average daily volume of $10 million or higher.

These ETFs are generated from my selected list of 90 that I use in my advisor practice. It cuts out the “noise,” which simply means it eliminates those ETFs that I would never buy because of their volume limitations.

While yesterday’s rebound was overdue after the recent slide, it only had a limited impact on this week’s report. The following equity ETFs slipped below the yellow cutline from their previous positive positions:

VPL (Japan Stock) from +5 to -1

BRF (Brazil small cap) from +4 to -2

SLX (Steel) from +3 to -3

EEB (Diversified Emerging Mkts) from +1 to -6

Again, when ETFs move above the line, that does not make them an automatic buy. You want those contenders to remain there for a while and build up positive momentum numbers all the way across (4 wk, 8 wk, 12 wk, YTD) before considering them as investment quality material.

If you look at the table, you will notice only one ETF that fulfills these criteria.

[Click on table to enlarge, copy and print]

It’s the same ETF from last week, namely PGF, which slid a little bit from +9 to +7. All momentum figures have remained positive across the board, and PGF has come off its high by only -0.38% (DD% column).

If you have new money to invest, this might be a good selection, subject, of course, to my recommended sell stop discipline.

If you are a new reader and missed the original Cutline report, which also featured some “how to use” information, please review it here.

Quick Reference:

Disclosure: No holdings in discussed ETFs

Contact Ulli